The contents of this blog post have been transcribed from our YouTube video, “What is Prevailing Wage?”

Project funding and changes in policy within the construction industry have increased the applicability of prevailing wage payments on projects. Enforcement is increasing, and the need to be in-the-know is higher than ever. Here is our summary of prevailing wage and what you should know to remain informed with the evolving project requirements.

Table of Contents

Prevailing Wage Defined

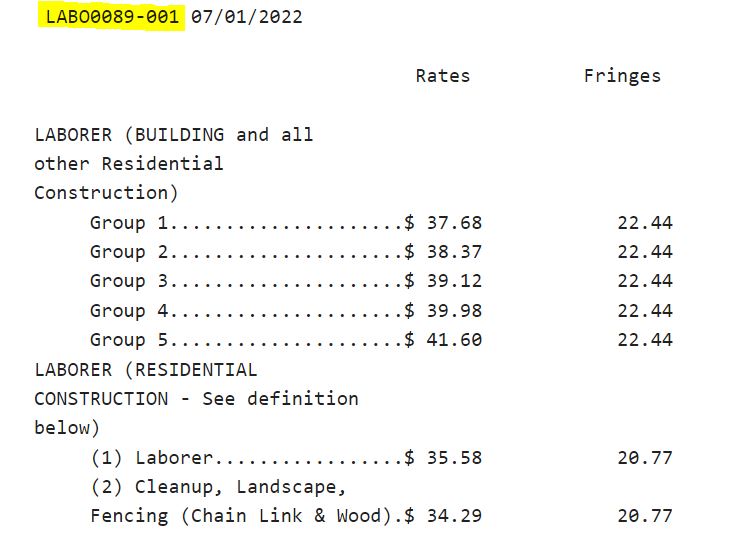

The U.S Department of Labor, also known as the DOL, defines prevailing wage as “the average wage paid to similarly employed workers in a specific occupation in the area of intended employment.” These average wages are then set to become a standard for payment. In short, prevailing wages can be known as the minimum wage that must be paid to employees performing work on Public Work construction projects. Prevailing wage varies depending on the actual work being performed by employees and the location of the Public Work.

As mentioned, prevailing wages are typically paid on public works projects across the nation. The definition of “Public Works” may vary from state to state. For example, per California Labor Code 1720, “Public Works” is defined as “the Construction, alteration, demolition, installation, or repair work done under contract and paid in whole or in part out of public funds. It can include preconstruction and post-construction activities related to a public works project.”

Prevailing Wage Applicability

Although public works projects are common in prominence with the payment of prevailing wage, prevailing wages may still be applicable to other construction projects that are not considered “public works.”

Taxpayers performing construction and attempting to claim tax credits and incentives under the Inflation Reduction Act can be required to pay Davis Bacon prevailing wages depending on the tax credit or incentive. Prevailing Wage applicability can also vary depending where your project is. In California, projects subject to Prevailing Wage are those that complete work under the Public Works definition, and are receiving public funding over $1000.

Exemptions to prevailing wage payment in California include projects less than $1000 in public funding and specific worker types, such as security guards and volunteers. The liability to pay prevailing wage in California is also project-wide and isn’t the general contractor’s sole responsibility. All contractors, sub and tier, are required to pay the prevailing wage rates if their applicability is triggered.

What’s at Stake

It’s best practice to remain informed on the prevailing wage information on the state and federal level to avoid underpayment penalties. In California, for example, Labor Code section 1775 states that penalties are assessed at no less than forty dollars ($40) for each employee and day they worked and were paid less than the prevailing wage rate. The penalty escalates to $120 for each calendar day if the violation is found to be an intentional disregard for prevailing wage.

Federal consequences can include debarment, payment for insufficient amounts on unpaid wages, liquidated damages for overtime underpayments, and contract termination amongst other penalties.

We offer a general state-by-state overview of compliance at the Federal and/or State levels. For more information or resources, feel free to watch our Frequently Asked Questions series and contact us if you need further assistance.