The contents of this blog post have been partially transcribed from our YouTube series, “Apprenticeship Series”

California prevailing wage mandates the use of apprentices on public works projects. Amongst the apprenticeship requirements are the proper documentation practices. We’ll be uncovering the DAS (Division of Apprenticeship Standards) 140, 142, and 7 forms and how to maintain compliance with the apprenticeship requirements.

Table of Contents

- The DAS 140 Form

- Completing the DAS 140 Form

- Finding Apprenticeship Halls

- Which Box to Check

- DAS 140 Penalties

- The DAS 142 Form

- Apprenticeship Registration

- Completing the DAS 142 Form

- DAS 7 Form

The DAS 140 Form

The DAS 140 form is the “Notice of Award” form. So, it’s most applicable to contractors utilizing an apprentice-able craft. The document is meant to work as a notice to apprentice halls that you’re working on a prevailing wage project. Enforced by Labor Code 1777.5(e), the law states, “Before commencing work on a contract for public works, every contractor shall submit contract award information to an applicable apprenticeship program that can supply apprentices to the site of the public work.” For a step-by-step guide, you can visit this video on our YouTube channel, “How to Fill Out a California DAS 140 Form.”

Completing the DAS 140 Form

The top of this form should be filled out with all of your basic info. This includes:

• Your company name

• Your company’s address

• Project address

• Awarding agency’s address

• Your state license number

• Your company’s phone number

• The date your contract was executed

• The actual or expected date that your company will start on site

The remainder of the top half of the form requires that you list the following:

• The estimated number of journeymen hours being worked

• The occupation/craft being utilized

• The estimated number of hours you’ll have an apprentice work

• An estimate of the dates you plan to utilize them

• The apprenticeship program/hall the form is going to

Entering a “0,” “TBD,”, “N/A” or blank on the following boxes may invalidate the form. So, if you don’t have the exact dates or hours, it’s best practice to place an estimate.

Finding Apprenticeship Halls

Since this document goes out to all apprentice halls of each of your apprentice-able crafts, multiple versions of this may be filled out and sent. The website listed at the top of this form is where you’d find all halls that this form is to be sent to.

You can access this site here. Let’s do an example.

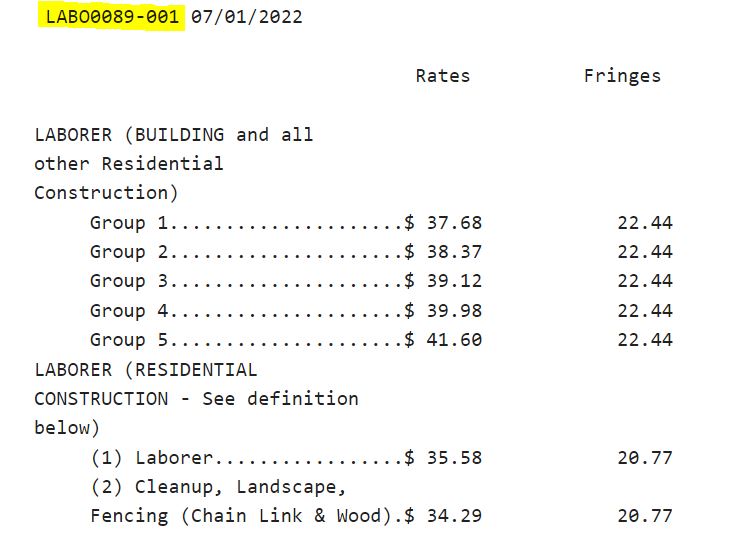

In our example, we are employing Laborers for a project located in San Diego County.

Once you hit “search,” a list of halls will pop up. Your DAS 140 form should go to all listed halls before you start on site. Even if the specific hall listed does not cover the scope of work you will be performing, the DIR still considers it to be applicable, and a DAS 140 form will still have to be sent.

Which Box to Check

There’s 3 options to choose from. Box 1, Box 2, or Box 3. Only one box should be selected.

Check off Box 1 if you’re signatory to a union hall and approved to train. Write the name of the union you’re signatory to on this line. If you’re checking box 1, then the DAS 140 would only have to be sent to this one hall.

Check box 2 if you are complying to a specific hall’s standards, paying your training to this hall, but are not approved to train. When you’re box 2, you will have to submit the DAS 140 to all halls listed on the DIR website.

If you check box 3, this means you will not be complying to any union’s standards and will be making your training payments for the listed classification to the CAC. You will also have to submit a DAS 140 to all halls listed on the DIR website.

DAS 140 Penalties

It’s crucial that this form is filled and sent out correctly, otherwise penalties of $300 per day, per classification may accrue, and that is a costly mistake.

The DAS 142 Form

The DAS 142 form is the “Apprentice Request Dispatch” form. For a step-by-step guide, you can visit this video on our YouTube channel, “How to Fill Out a California DAS 142 Form.” This form is utilized to help aid contractors in hitting a 20% apprentice ratio. Per CCR Title 8 Section 230.1, 20% of the workforce that you employ should consist of registered apprentices.

An apprentice is an employee who is undergoing an apprenticeship program approved by the Department of Apprenticeship Standards and is also registered in the state of California.

Apprenticeship Registration

If an employee is not registered with the state as an apprentice, they cannot be classified as an apprentice and must be paid the journeyman rate when working on a public works project. This discretion is also applicable if their apprenticeship status has expired by the time they’ve performed work on site. You can access this information using the DIR apprenticeship status lookup tool.

Completing the DAS 142 Form

The first section of this form outlines the website contractors can use to verify where the form can be sent. It also references the increments that you must hire an apprentice under.

In the second section, contractors must list the date, the applicable apprenticeship committee the form is being sent to, and your contractor information. If you checked box 2 or 3 on the DAS140, this form should be sent to the corresponding halls that your DAS 140 form was sent to.

In the third section, you must list the project information. If you have any questions regarding this portion of the form, please refer to your prime contractor.

The fourth section is the most important one. This is how the apprentice will know where to go and what time to show up. Let’s break it down.

The areas above are going to be filled out with two points in mind. First, the requested apprentice must be hired in 8 hour increments as referenced in Section 1. Second, the form must be sent 72 hours before the apprentice is needed as referenced in Section 5.

This 72 hour notice does not include weekends or holidays.

If this form is sent without these two criteria being fulfilled, it may be considered invalid. Underneath the dispatch request information, you should input the following:

• The number of apprentices needed

• The craft or trade they will work under

• The date and time they’re expected to report

• The name of the person they’re to report to on site

• The address of the project

It’s important to note that all information should be filled out accurately. Again, if any “0s,” “N/As,” “TBDs,” or blanks are located on the form, it may be considered invalid.

DAS 7 Form

Proof of approval to train apprentices includes an “approval to train” letter from your union, or a DAS 7 form.

The DAS 7 is a form intended to be filled out by the union hall verifying that your company is approved to train for the applicable craft. This form may be requested to verify that marking Box 1 on the DAS 140 form is accurate.

Contractors’ priority with this form is to ensure that it’s readily available to fulfill this request.

If you do not have this documentation, then your company may not be approved to train. With this, you may need to check Box 2 or Box 3 on the DAS 140 form to reflect an accurate status. For more information or resources, feel free to watch our Apprenticeship Series and contact us if you need further assistance.