Proper classification of employees is a principal point in remaining in compliance with federal regulations. Here’s a breakdown of what “classifications” are and how you use them.

- What is a Classification?

- How to Classify an Employee Under Prevailing Wage

- Best Practice for Classifying an Employee on Payroll

- What are the Effects of Misclassifying Employees?

- Conclusion

What is a Classification?

A “classification” is an identifier or title signifying the skill, work, responsibilities, and duties of an employee. Classifications serve as a way of categorizing your employee, and this aids in defining things such as job roles and wage rates. Other commonly exchanged terms in the realm of classifications include “trades” or “crafts.” The term “craft” is used synonymously alongside “trade” and means “an occupation requiring manual skill.”

How to Classify an Employee Under Prevailing Wage

Employees should be classified based on their scope of work. An employee’s scope of work description would include the skills, tasks, machines/tools being used, and even materials being handled. The Wage and Hour Division (WHD) publishes the prevailing wage rates covered under the Davis Bacon Act that includes a list of classifications and the rates owed. These can be found at sam.gov. Here are the main steps to keep in mind as you complete your search:

1) The following are used to find your Davis Bacon project’s wages:

a. Your project’s state

b. Your project’s county

c. Construction type

d. Your project’s bid advertisement date (alternately, the contract award date)

Entering this information onto the wage determinations page should generate the applicable wages for your project.

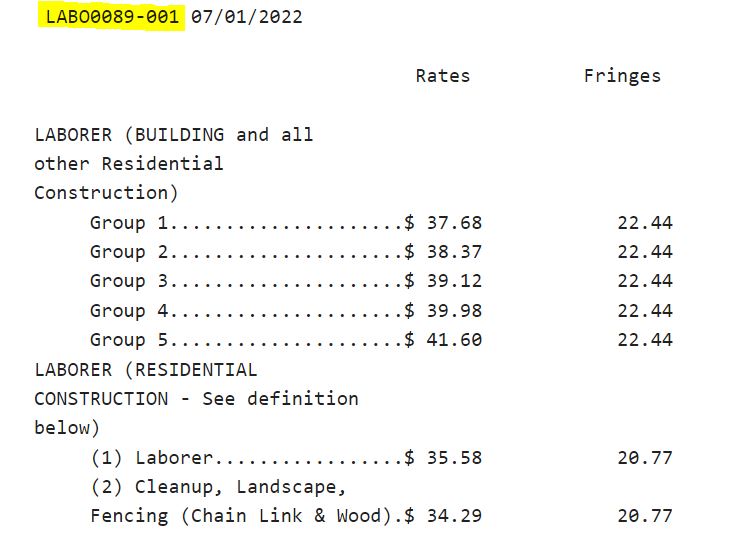

The classifications within the wage determination are listed with a union code identifier above the classification title. This may look like this:

This identifier points to the union that was surveyed to retrieve the classification’s rates. Please note, you do not need to be signatory to a union for this to be applicable. The union within the identifier could be referred to for the scope of work description or comprehensive list of tasks that would be performed by its corresponding classification. As previously mentioned, this would include the main identifiers that would align with whatever skills, tasks, machines/tools being used, or material being handled by your employees. Common classifications can include Laborers, Carpenters, or Electricians. If you’d like to contact the union to find their scope of work description, you can decipher what union is listed with the following indicators:

• A four-letter abbreviation of the classification

• The local union number following the abbreviation

From the above screenshot, the listed union would be the Laborers Local 89.

There are no established nationwide standard classification definitions under the Davis Bacon Act, so contractors are encouraged to examine “local area practice.” Thus, the act refers to the Wage and Hour Division (who publishes the wage determinations) and/or local construction industry stakeholders for determining the classification of your employees (scope of work assigning assistance).

Best Practice for Classifying an Employee on Payroll

When reporting on payroll, it’s best practice to classify employees based on the work they performed within the day. This affects how an employee appears throughout the week if they are skilled in several trades and certified to perform different types of work – they might be used to complete a variety of tasks across the project. So, they should be classified as such. Keeping timecards and descriptions of the work completed can assist with recordkeeping.

Let’s use some of the previously listed common classifications as an example.

If an employee were performing tasks exclusive to Laborers on Monday and were then performing tasks exclusive to Carpenter on Tuesday, the employee would be reported as the Laborer classification on Monday and the Carpenter classification on Tuesday.

This is additionally important to note because of the difference in required wage rates to the classifications. If an employee were listed as a Classification A and receiving the wages assigned to Classification A but were actually performing the tasks of a Classification B, a classification with a higher wage rate, the contractor may be subject to penalties for misclassification and underpayments.

What are the Effects of Misclassifying Employees?

The Wage and Hour Division closely examines the classification of employees. A common mistake in classifying employees is assigning an “independent contractor” status. In a recent case based in Alabama, an aviation maintenance shop was reported misclassifying employees as independent contractors. The Department of Labor recovered $127,249 back in wages from this case.

Conclusion

Classifications help in standardizing work across the industry. Maintaining records of the scope of work performed by your employees and classifying them appropriately prevents contractors from misclassifying employees and potential underpayment penalties.

Have any further questions? Let’s get in touch.