Introduction

Prevailing wage compliance isn’t just about checking a box—it’s a critical safeguard that ensures workers receive fair wages while protecting contractors from costly violations. Yet, one of the biggest pitfalls companies face in prevailing wage and apprenticeship compliance is the misconception that payroll records alone tell the full story.

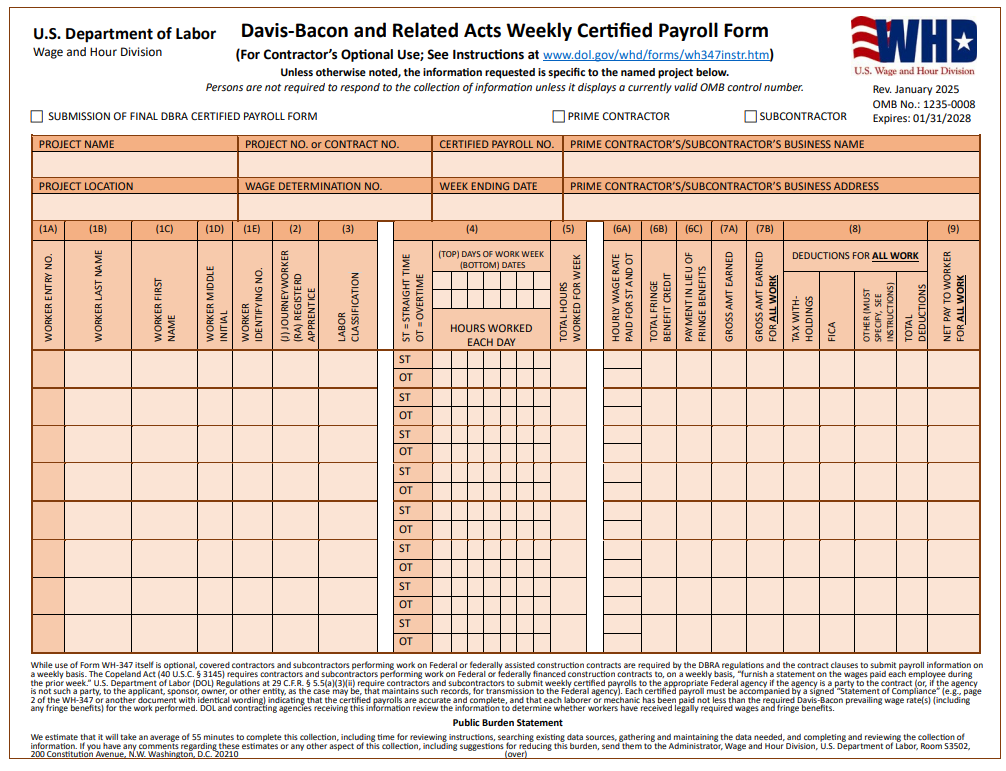

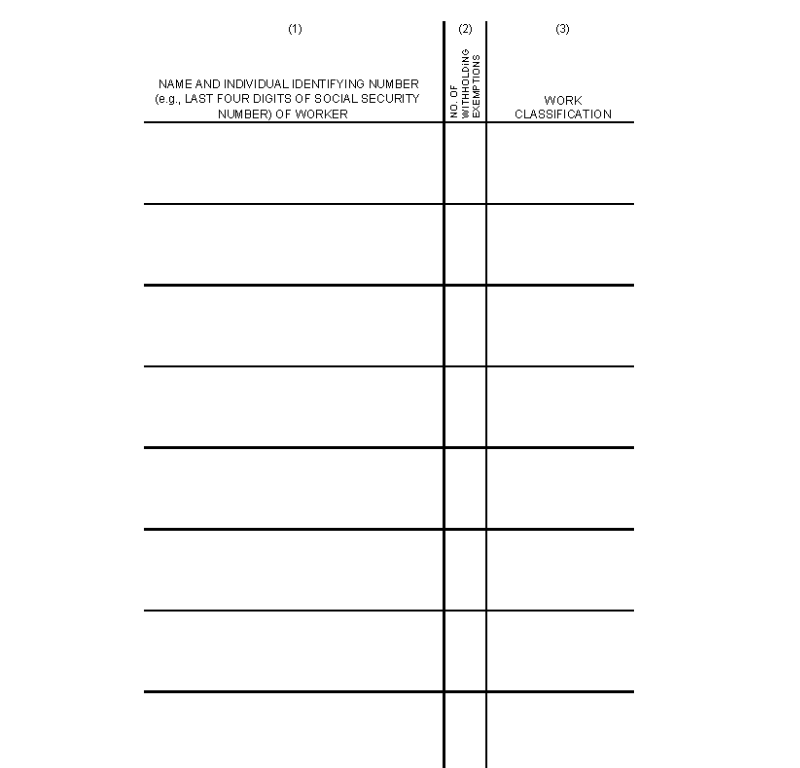

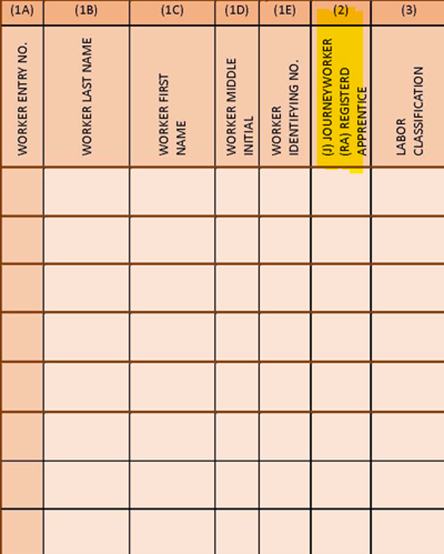

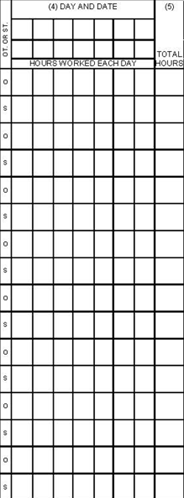

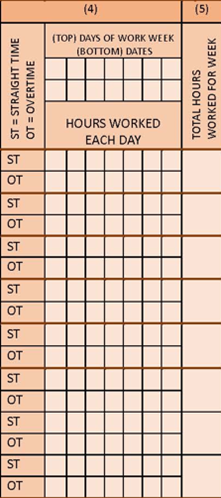

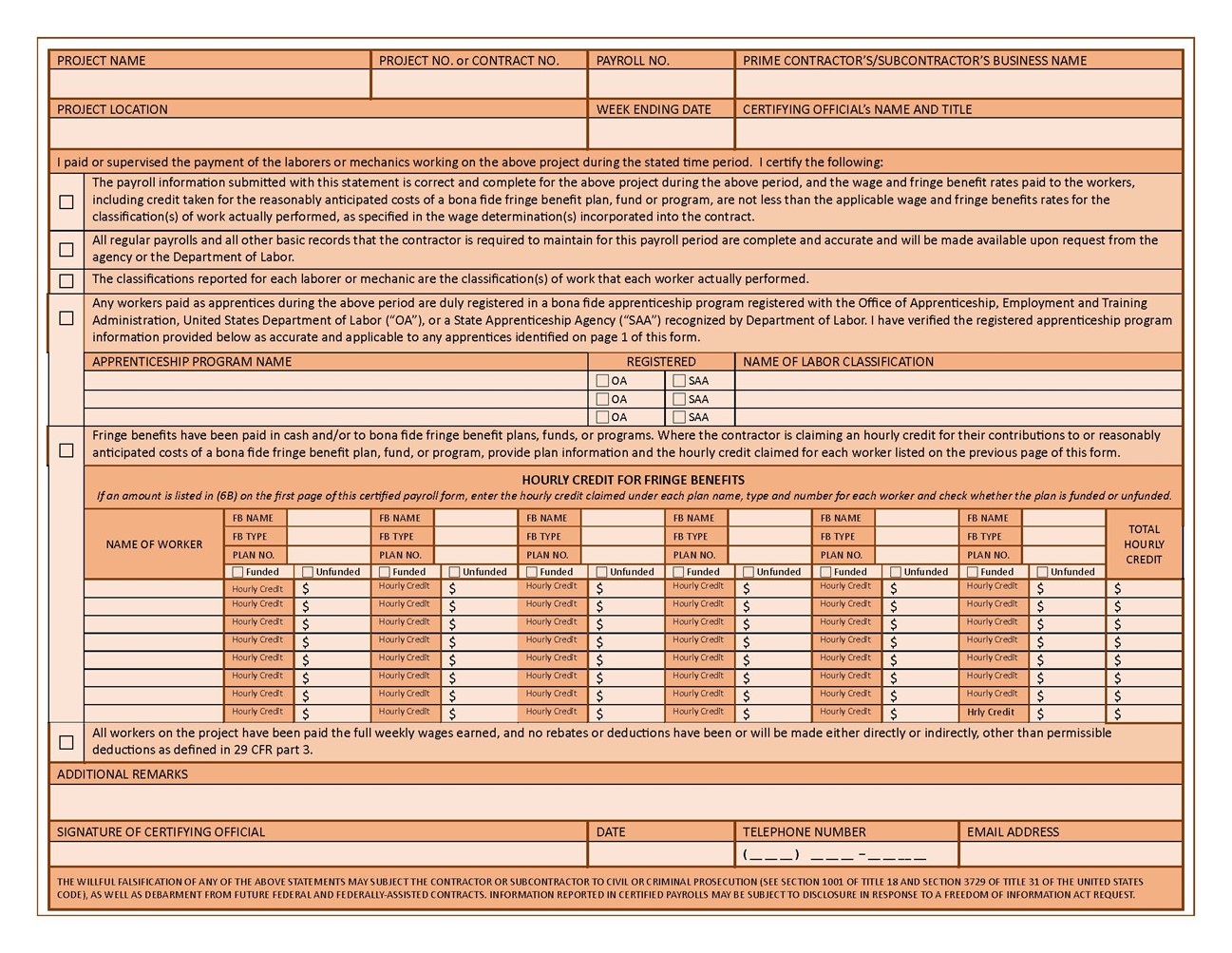

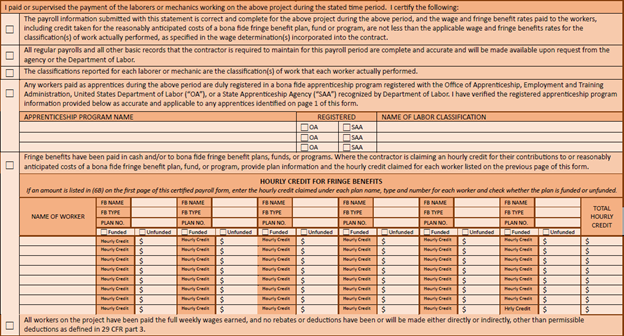

Many businesses assume that submitting payroll records is enough to satisfy compliance requirements. But in reality, payroll records can be manipulated, contain errors, or, they can miss key information. Without supporting documentation like pay stubs, time cards, fringe benefit remittances, and other forms of verification, proving that prevailing wages have actually been paid becomes nearly impossible. This misunderstanding can lead to audits, penalties, and even legal trouble—risks that no company wants to face.

The Costly Consequences of Overlooking Compliance

Failing to properly document prevailing wage payments can result in:

- Loss of Tax Credits/Funding – Funding earned with prevailing wage provisions within the project may be lost when prevailing wage requirements aren’t met.

- Financial Penalties – Agencies conducting audits won’t hesitate to issue heavy fines when compliance isn’t fully demonstrated.

- ex. IRS issues a penalty of $5,000 for each laborer or mechanic who was not paid at the prevailing wage rate in the year under the Inflation Reduction Act.

- Project Delays or Disqualifications – Non-compliance can halt work or even disqualify companies from future bidding opportunities.

- Legal Liability – In worst-case scenarios, businesses may face legal action for misrepresenting wage payments.

These consequences don’t fall solely on the contractors working on the project. Even if a group isn’t performing work on-site, that doesn’t mean they are exempt from adhering to prevailing wage requirements. Higher-level parties tied to a project with prevailing wage funding—such as within the IRA, for example—are liable for all penalties accrued by contractors if they are capturing IRA credits. This differs from public works projects, where the contractor is penalized directly.

Common Mistakes

In our 20+ years of experience, we have seen a wide range of mistakes. Some of the most common mistakes we’ve witnessed made on payroll records alone include, but are not limited to:

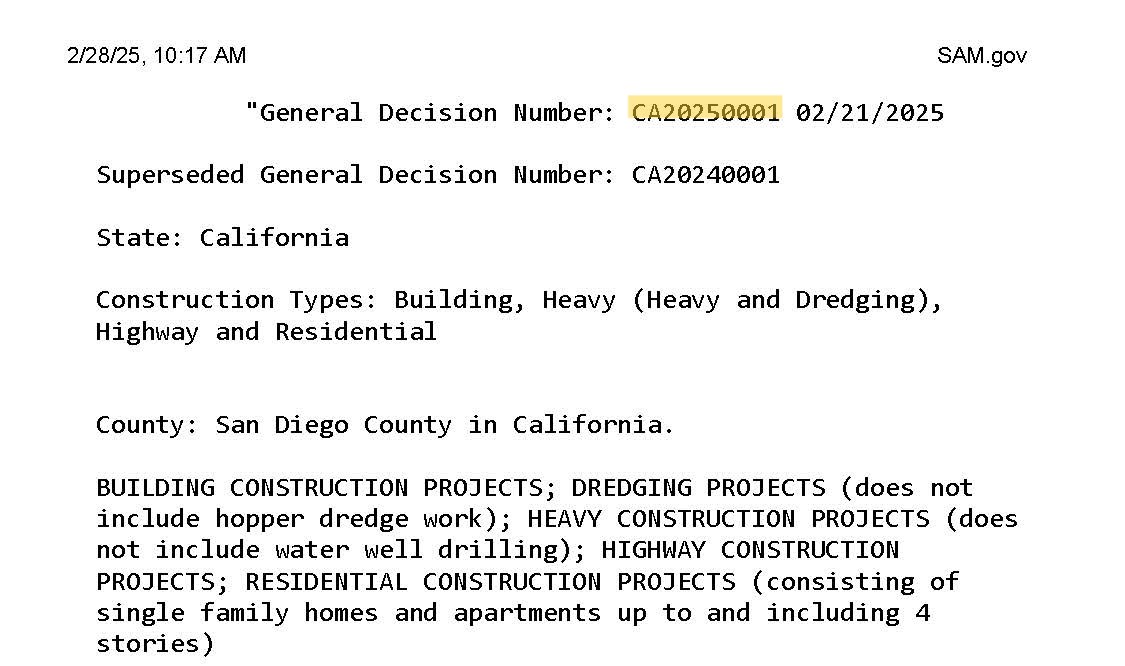

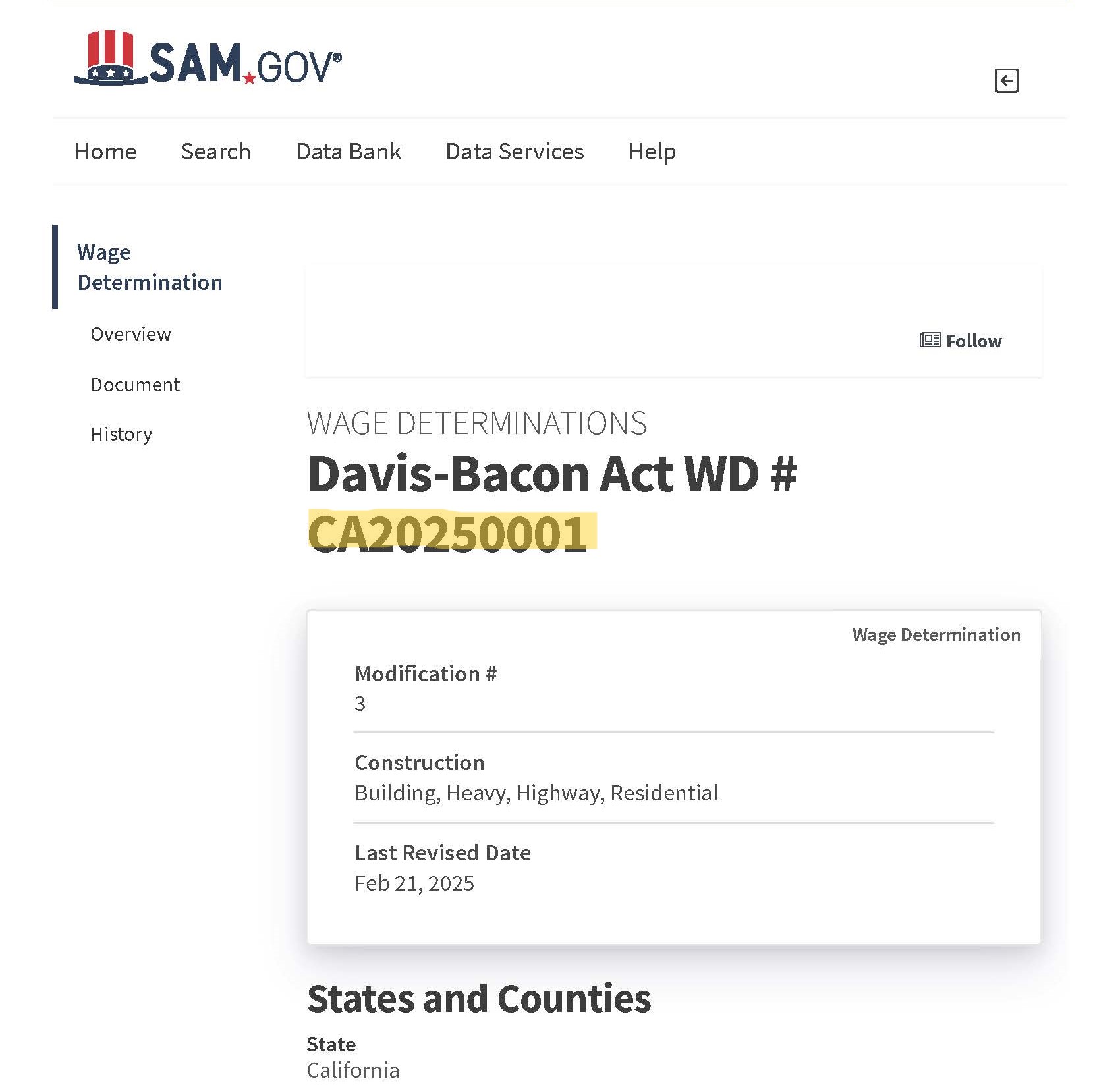

- Incorrect Prevailing Wage Rates

- Misclassification

- Mis-reported Hours

- Missing Employee Benefits

- Unauthorized “Other” Deductions

- Incorrect Overtime Issuance

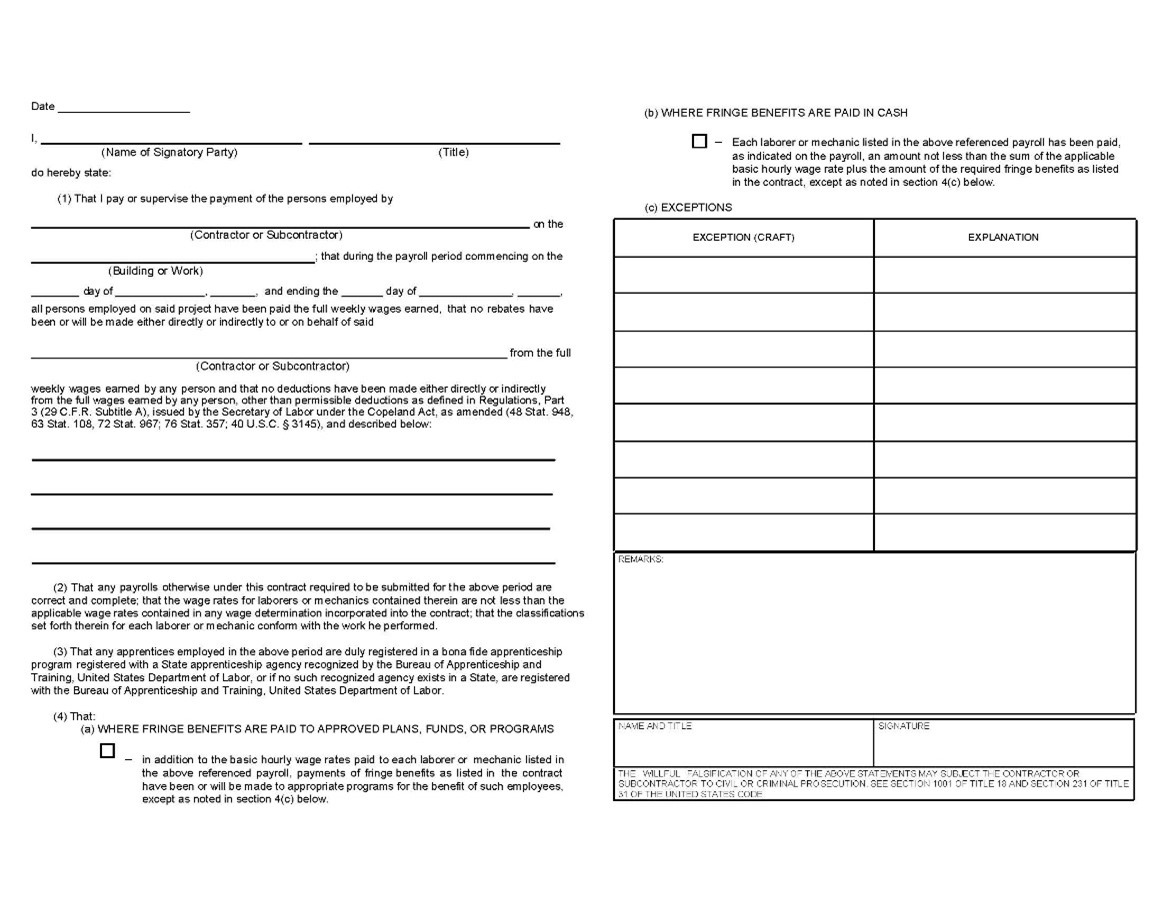

- Missing Statement of Compliance

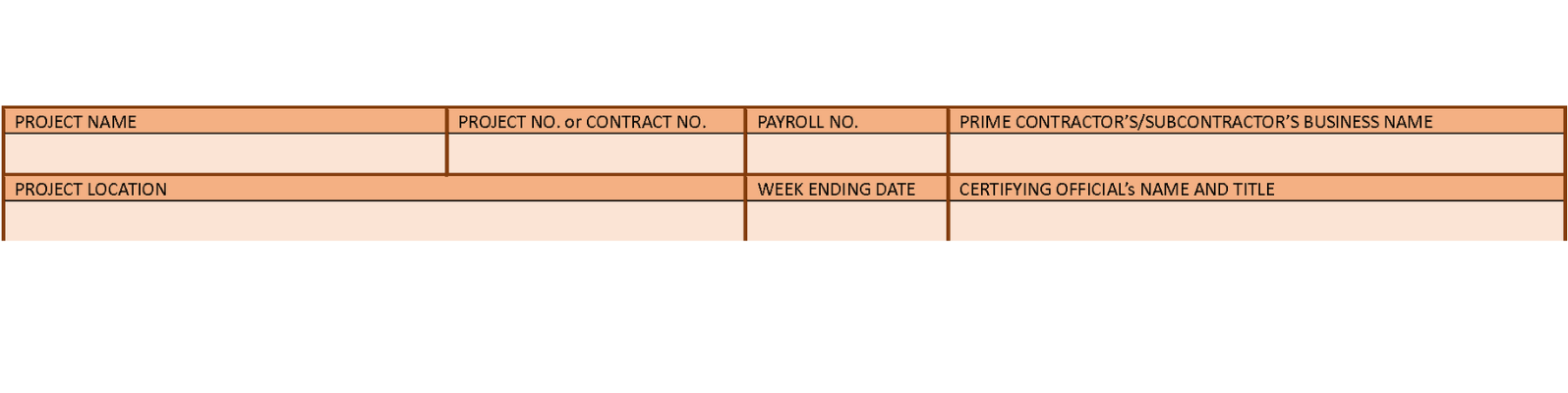

- Incorrect Project Information

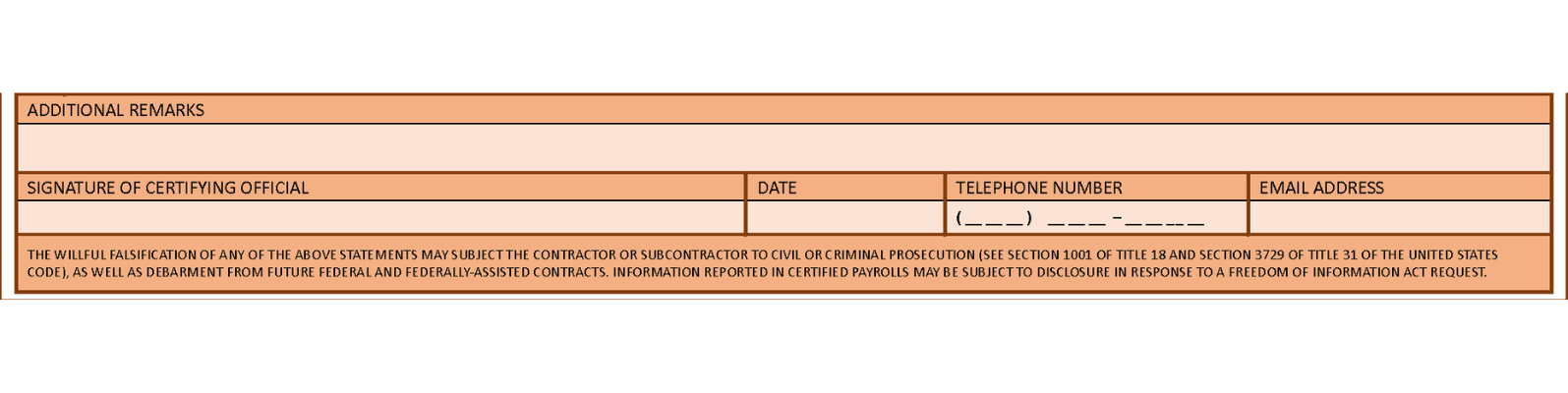

When these mistakes are made, the liability varies depending on the project type. For IRA, liability would fall upon the taxpayer, whereas on public works projects, liability can come down directly to contractors. Generally, consequences can be faced at all levels, and it is upon the contractors, developers, and EPCs involved to make sure these errors are corrected, restitution is paid, and that substantial evidence is provided to prove the accuracy on the records.

Projects can last anywhere from weeks to years, and the document collection process over the course of a project should be clarified as early as possible to prevent potential back-logging of completed work. One of the largest challenges groups face is a lack of timely documentation review, as some tend to only conduct review quarterly. It’s best practice to detect non-compliance early on to prevent issues from stacking and becoming costly or difficult to resolve. Regular, proactive documentation reviews help identify discrepancies before they escalate. Establishing a clear process for document collection and compliance checks from assists with smoother project execution and minimizes the risk of penalties or delays.se, check out our video tutorial here.

Why Hiring a Seasoned Labor Compliance Firm Matters

Navigating prevailing wage requirements is complex, and missing a single critical detail can put your company at risk. A seasoned labor compliance firm ensures that your documentation is airtight—verifying every aspect of wage payment, benefits, and worker classifications to protect your company from compliance pitfalls. Here’s what an experienced compliance firm brings to the table:

Experience – Connecting with a team that’s seen it all matters. You want to know that you are aligning with people that have a track record of compliant projects and the knowledge needed to meet your needs. Having years of experience equips experts with the skills of knowing exactly what to look for and having a wealth of knowledge that can only come from time in the space.

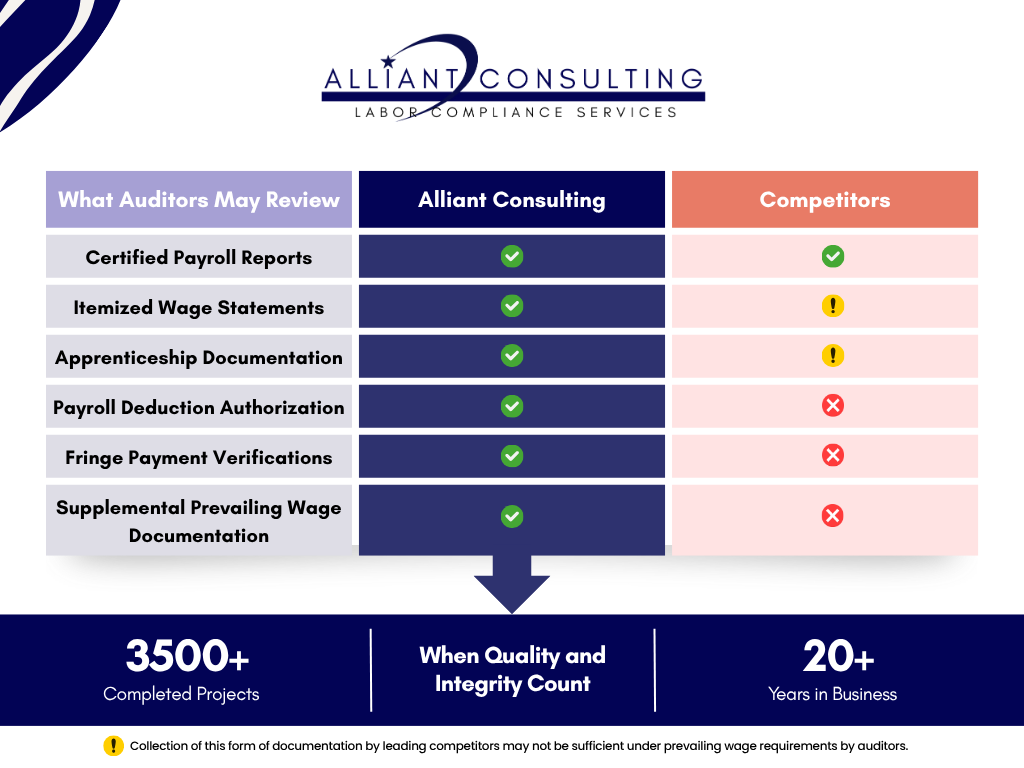

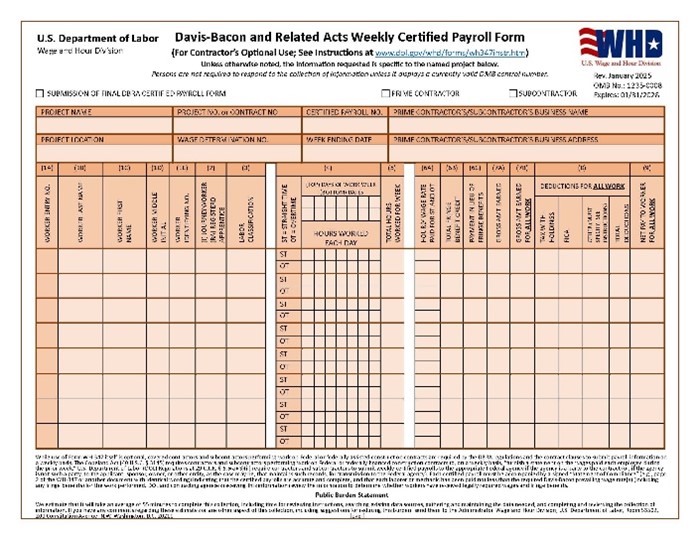

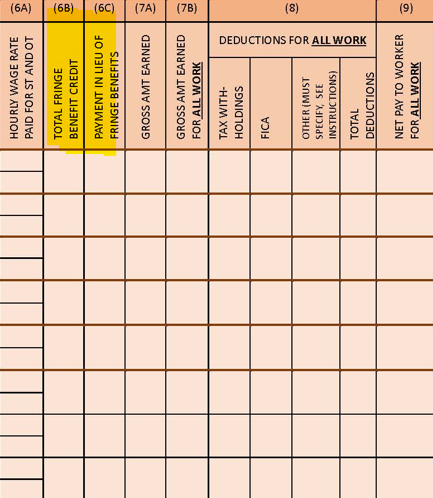

Comprehensive Documentation Review – Payroll records are just the beginning. A compliance firm verifies that the submitted time cards, pay stubs, and all cumulative supporting documentation align with reported wages. At Alliant, the documents we collect include, but are not limited to, certified payroll reports, apprenticeship documentation, itemized wage statements, payroll deduction authorization forms, fringe payment verification, and all supplemental prevailing wage documentation.

Audit Prevention Strategies – By proactively addressing compliance gaps, expert consulting firms help businesses avoid costly penalties. This assists in saving time and creates a safeguard if experts are added onto the project before it even starts.

Expert Guidance – With evolving regulations, a compliance firm ensures you’re always ahead of changes, keeping your business compliant and secure. Prevailing wage is constantly changing and can be confusing. Having a team dedicated to remaining up-to-date with prevailing wage laws to answer your questions is paramount to securing your project’s protection.

Secure Your Compliance Before Auditors Step In

Businesses that underestimate the importance of thorough compliance documentation risk financial and reputational damage. Payroll records alone don’t represent a project’s prevailing wage and apprenticeship compliance—comprehensive supporting documentation is the key to proving wages have been properly paid.

Don’t let compliance confusion put your company in jeopardy. Our team specializes in guiding businesses through prevailing wage requirements to ensure full compliance. Reach out today to safeguard your projects and avoid unnecessary risks.