Tag: Labor Laws

What to Know About the New WH-347 Form

Table of Contents

- Introduction

- Basic Information Section

- Employee Information Section

- Work Week Hours

- Payment Section

- Notice and Public Burden Statement

- Page 2

- Authorized Certifier Information

- Certifications

- Additional Remarks and Signature

- Getting Assistance with the WH-347

Introduction

The WH-347 form is a weekly certified payroll report template for contractors to use on projects subject to the Davis-Bacon and related Acts. While the use of the form itself by contractors is optional, it contains information that is required to be maintained under the Davis-Bacon Act, and its use can ease the payroll process.

The form was recently revised, and knowing how to properly complete the form with the changes in mind is key to verifying that you are compliant with the DBA payroll reporting requirement. Walk through the major differences side by side and how to complete each section below.

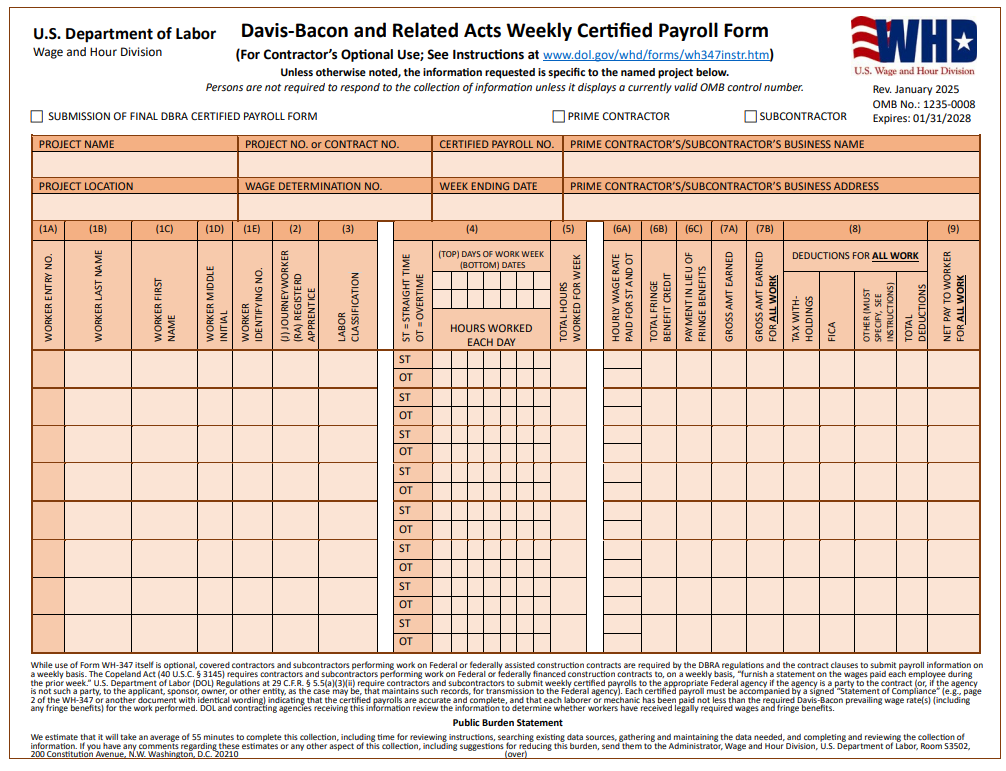

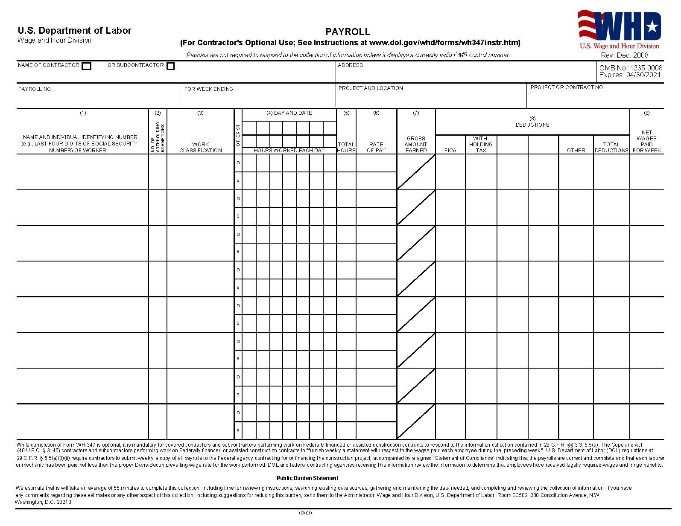

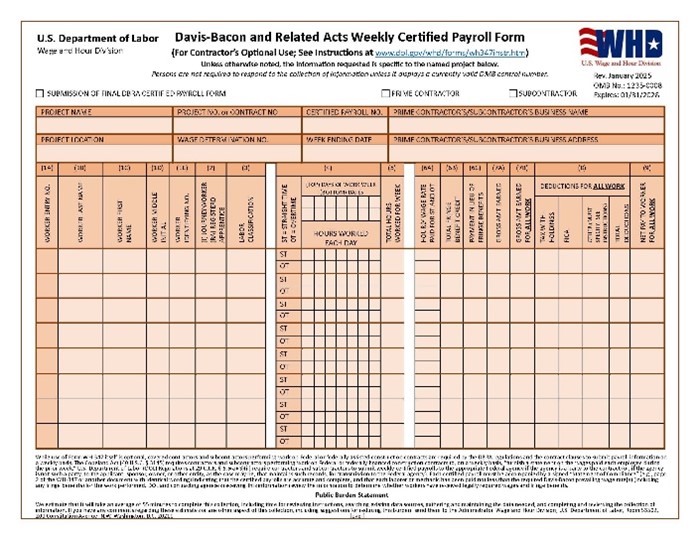

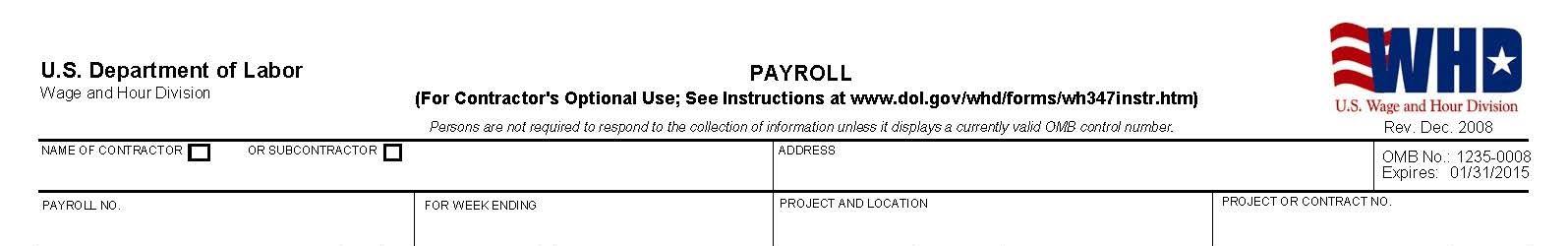

Old WH-347 |  New WH-347 |

Basic Information Section

The “Basic Information” section containing basic info about the contractor, project, and payroll have taken a new table format. All information on the old form still remains on the new one, with the new addition of the “Wage Determination No.”.

Old WH-347 |

New WH-347 |

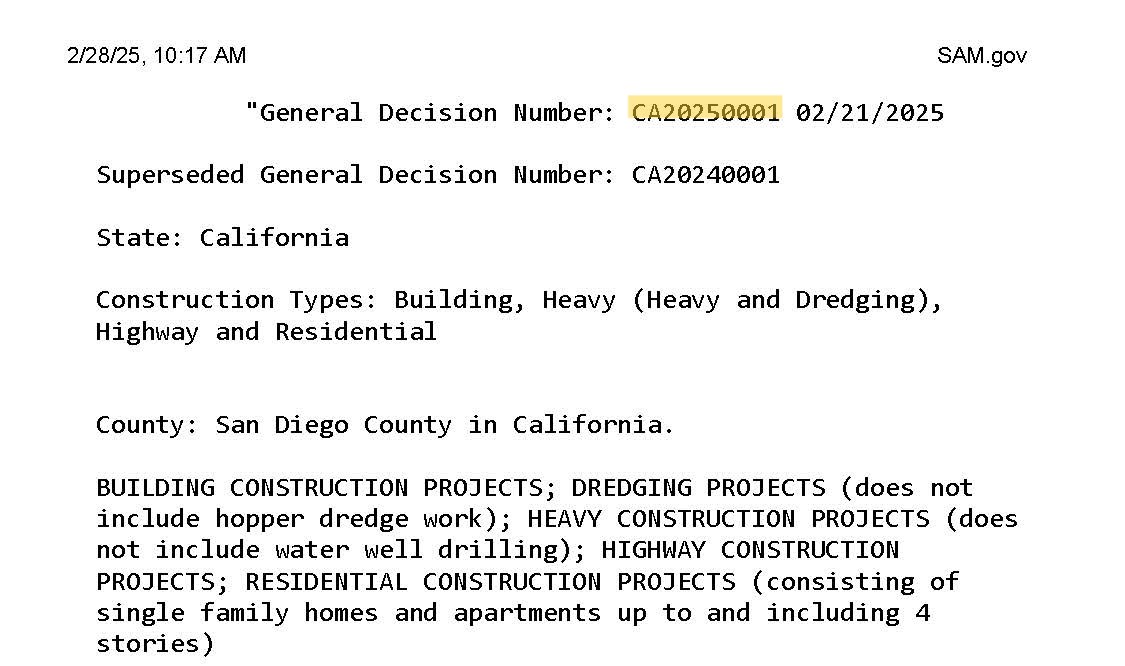

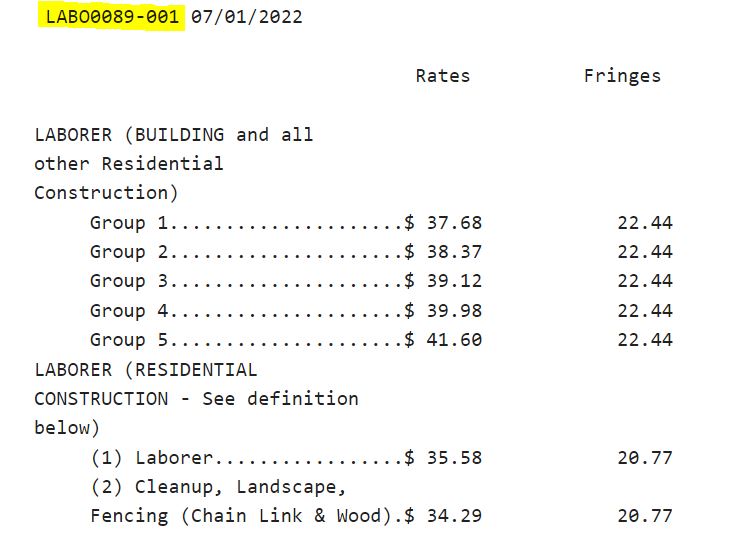

- Wage Determination No. – DBA projects have a “Wage Determination” set for the project, which is a list of applicable wages and fringe benefits for all trades that would be on the project, dependent on factors like the Contract Award Date and project location. The Wage Determination No. would be the General Decision Number found at the top of your wage determination page

The remainder of the information on the Basic Information includes:

- Project Name

- Project Location: The address of the project site.

- Project No. or Contractor No.

- Certified Payroll No.: A sequential number for the week’s submission. For example, if this is the first payroll, the Certified Payroll No. would be 1. For the following week, it would be 2, etc.

- Week Ending Date: The date of the last day of the recorded pay period. For example, if a payroll week ran from 2/10/25 – 2/16/25, the week ending date would be 2/16/25.

- Prime Contractor’s/Subcontractor’s Business Name: Your business name.

- Prime Contractor’s/Subcontractor’s Business Address: The address of your business location.

Employee Information Section

Old WH-347 |  New WH-347 |

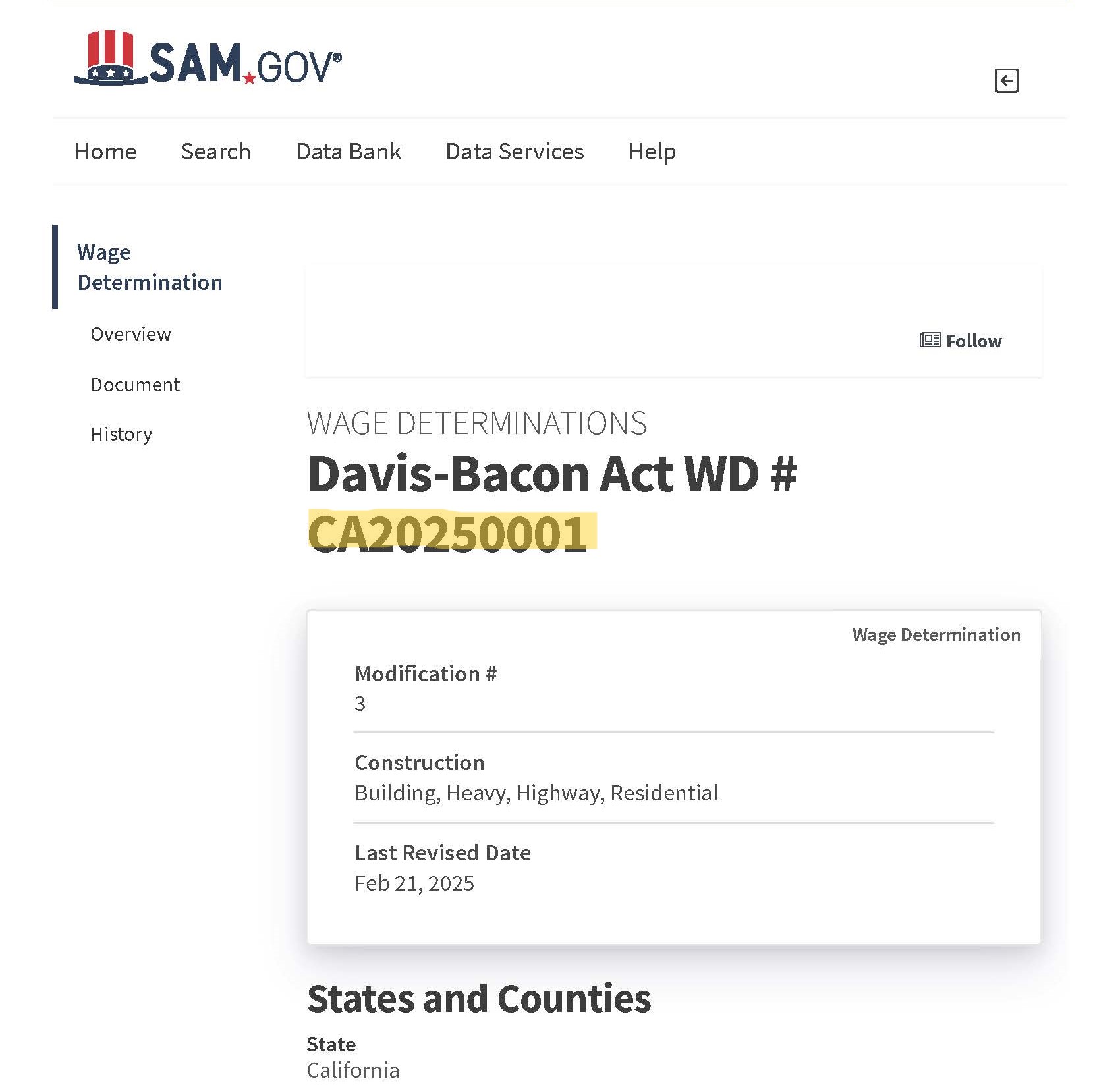

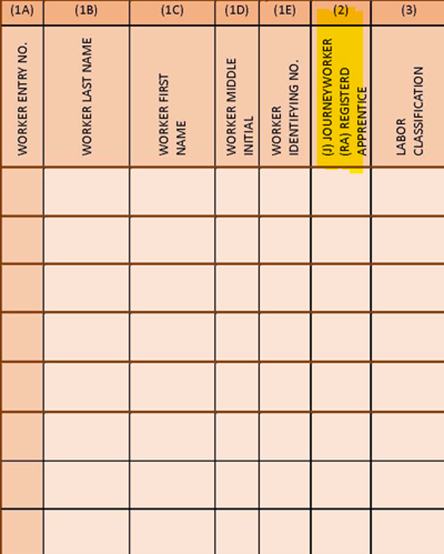

The information under Column 1 of the old form has been broken out into separate columns of the new form. The No. of Withholding Exemptions column from the old form was removed, and the (J) Journeyworker (RA) Registered Apprentice column and Worker Entry No. columns were added.

- (J) Journeyworker (RA) Registered Apprentice: Write in J if the employee is a journeyworker. Write in RA if the employee is a registered apprentice, meaning they are undergoing an apprenticeship program with a registered institution.

- Worker Entry No. – The sequential number of the employee listed. For example, the employee listed in the first row would be Entry No. 1, the second would be 2, etc.

The remainder of the information maintained in this section includes:

- Worker Last Name

- Worker First Name

- Worker Middle Initial

- Worker Identifying No.: A unique identifier, such as the last four numbers of their Social Security Number or an employee ID number.

- Labor Classification: The classification or trade title as it correlates with the one listed in the wage determination. Examples include Carpenter, Electrician (Cable Splicer), Operator: Power Equipment (Tunnel Work) Group 3, etc.

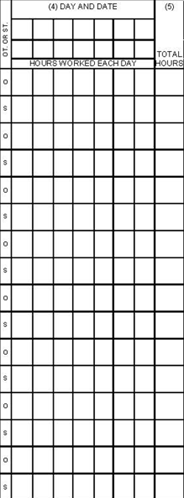

Work Week Hours

Old WH-347 |  New WH-347 |

All areas under this section remain the same, with a few slight positioning adjustments of the Straight Time and Overtime hours.

- Days of the Work Week

- Top: Ex. M, Tu, W, Th, F, Sa, Su

- Bottom: Ex. 2/10, 2/11, 2/12, 2/13, 2/14, 2/15, 2/17

- Work weeks aren’t required to occur on a Monday – Sunday structure and would follow the date range of your pay period.

- Hours Worked Each Day

- ST (Straight Time) – Number of hours worked at a regular, non-overtime rate for each day.

- OT (Overtime) – Number of hours worked past the straight time rate for each day.

- Total Hours Worked for Week

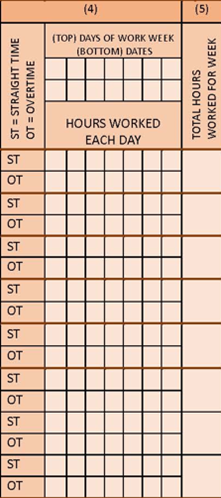

Payment Section

Old WH-347 |  New WH-347 |

All areas from the old form were maintained with the addition of two new columns, the Total Fringe Benefit Credit column and the Payment in Lieu of Fringe Benefits column.

- Total Fringe Benefit Credit – The total gross fringe benefit credit earned across all hours worked within the week. Ex. $20 in fringes x 30 hours = $600

- Payment in Lieu of Fringe Benefits – The cash amount a worker earned instead of fringe benefits. This is separate from the base rate earned in cash.

The remaining fields include:

- Hourly Wage Rate Paid for

- ST (Straight Time): The hourly straight time rate the worker is being paid in accordance with their classification.

- OT (Overtime): One and a half times the base hourly rate.

- Gross Amount Earned: The sum of all earnings across the base hourly rate and fringes for the project.

- Gross Amount Earned for All Work: The sum of all earnings across the base hourly rate and fringes for all projects this employee is contracted on that would reflect the pay stub.

- Deductions for All Work:

- Tax Withholdings: All applicable taxes, including those that are mandated federally, locally, etc.

- FICA: Federal Insurance Contributions Act – federal social security and Medicare contributions.

- Other: All other potential deductions authorized by the employee. If the amount is specific to a single deduction, it must be described under the “Additional Remarks” on page 2 of the form. If there are several deductions under the “other” category (ex. life insurance, pension, etc.), an addendum must be submitted that itemizes each deduction with a description and amount for each.

- Total Deductions: The sum of all deductions.

- Net Pay to Worker for All Work: The actual dollar amount paid to the worker for all hours worked across all projects during the week.

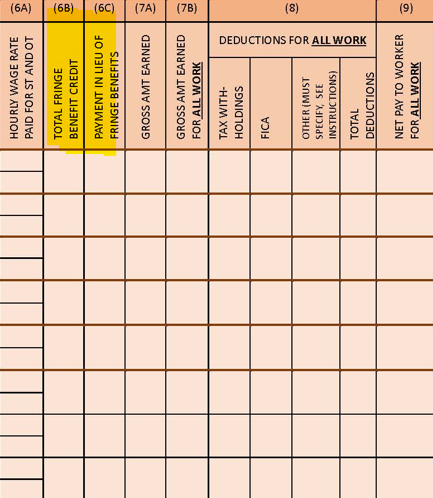

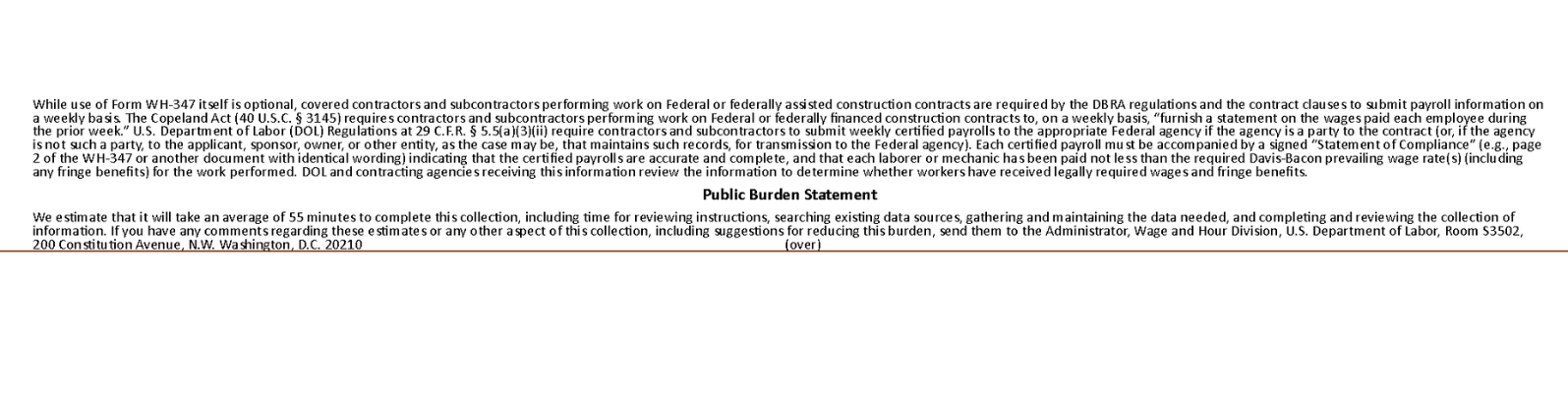

Notice and Public Burden Statement

Old WH-347 |

New WH-347 |

The statement at the bottom of the page has been revised, but the basis of the content includes:

- The Requirement to Submit Payroll Weekly (The Copeland Act (40 U.S.C. § 3145)

- The Requirement to Include All Required Information on Payroll (29 C.F.R. § 5.5(a)(3)(ii))

- The Requirement to Sign a “Statement of Compliance”, Noting That Payroll is Accurate Under Penalty of Perjury

- Acknowledgment of Time Commitment Required to Complete Form

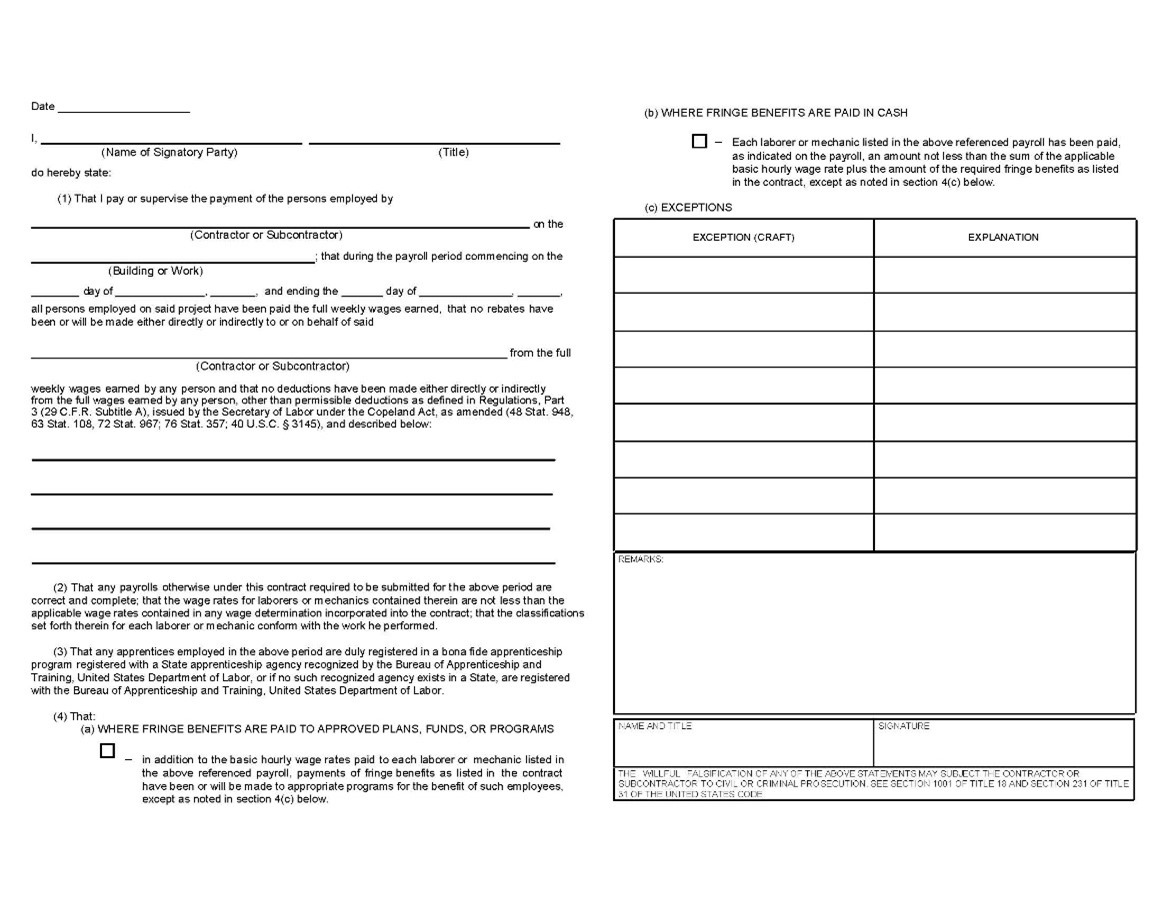

Page 2

The second page of the WH-347 received a complete revamp:

Old WH-347 |

New WH-347 |

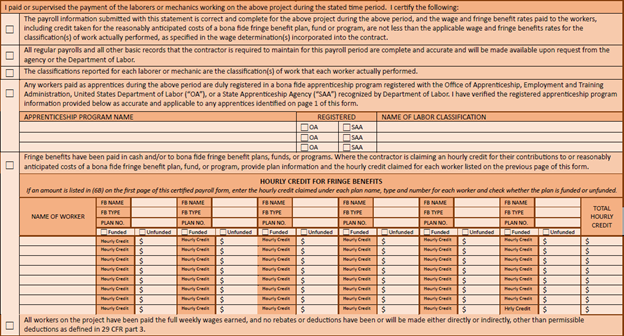

Both versions contain a Statement of Compliance, but the second version separates the statements with certifications of Proper Payment, Accurate Payroll and Obligation to Supply Records, Work Performed, Apprentices, Fringe Benefits, and Deductions.

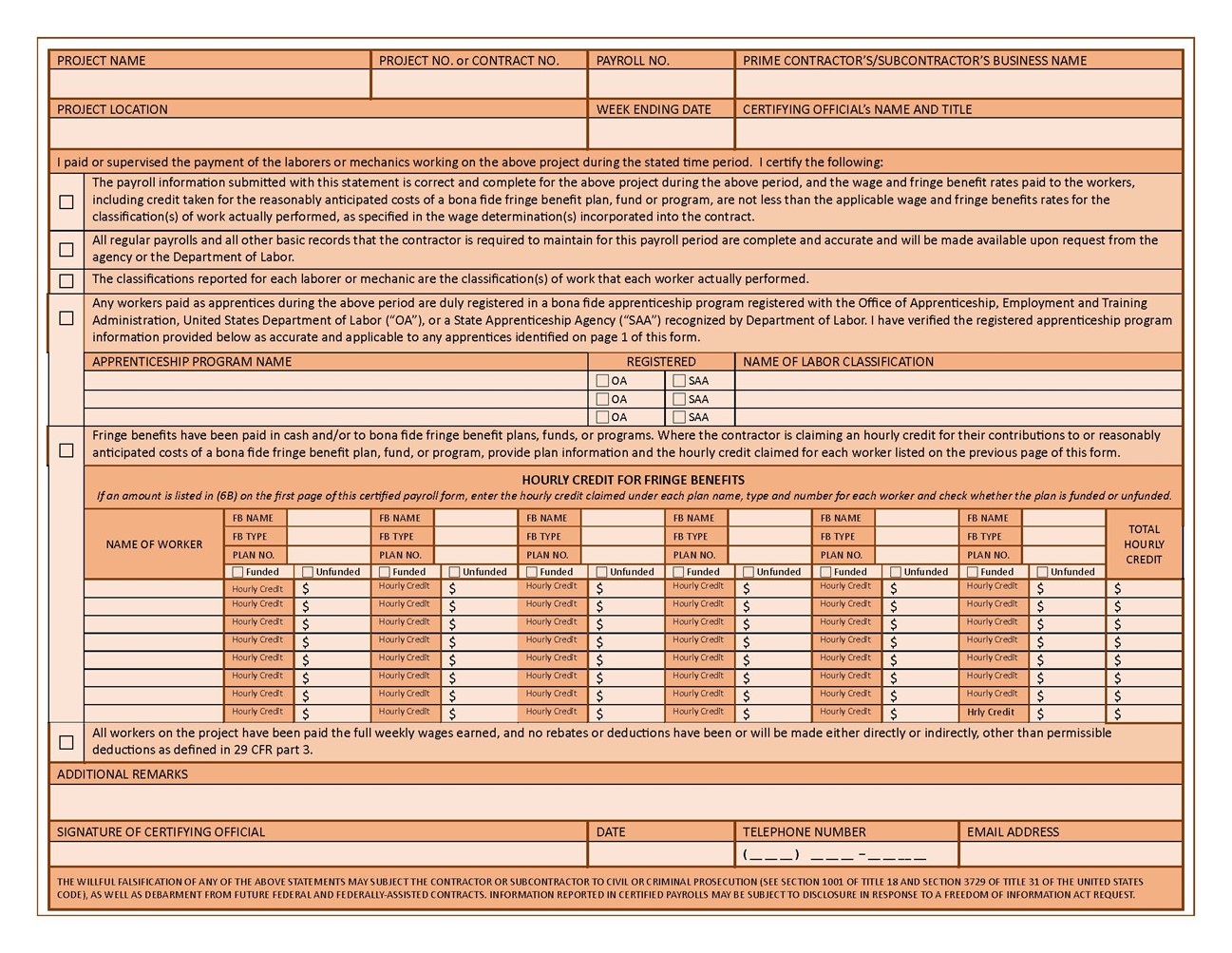

Authorized Certifier Information

- Project Name

- Project Location

- Project No. or Contract No.

- Payroll No.

- Week Ending Date

- Prime Contractor’s/Subcontractor’s Business Name

- Certifying Official’s Name and Title – This individual should verify that they were given authorization by a party to certify all information included on the payroll report. Their name and title/position should be written in.

Certifications

- Box 1, Certification of Proper Payment

- Box 2, Certification of Accurate Payroll and Obligation to Supply Records

- Box 3, Certification of Work Performed

- Box 4, Certification of Apprentices: If apprentices are employed during the work week, the programs that they’re registered under, the body that the program is registered with, OA (DOL’s Office of Apprenticeship) or SAA (State Apprenticeship Agency), and the name of the labor classification working.

- If not applicable, leave the box unchecked and enter “N/A” under the blank sections.

- Box 5, Certification of Fringe Benefits

- If you’re claiming an hourly credit for contributions to benefit plans, funds or programs, this box should be checked with the following information completed:

- Name of Worker

- FB Name: Fringe Benefit Name (Ex. Anthem)

- FB Type: Fringe Benefit Type (Ex. Health Insurance)

- Plan No.

- Funded or Unfunded

- Hourly Credit

- Total Hourly Credit

- Per the DOL, if more than six bona fide fringe benefits are provided to the workers for which the contractor is claiming a credit, submit an addendum for each providing the information requested in this section.

- Box 6, Certification of Deductions

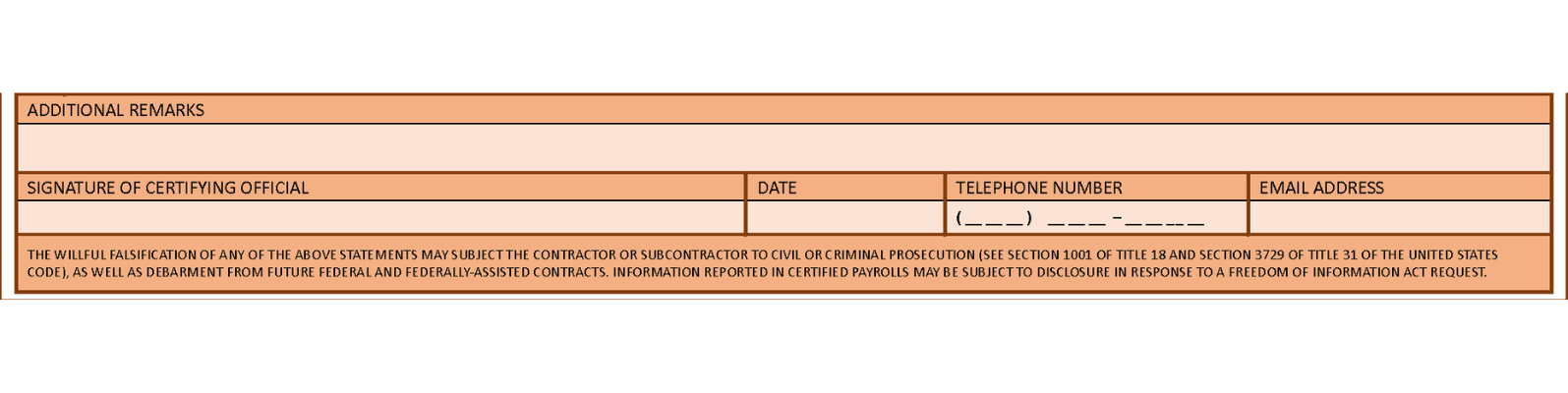

Additional Remarks and Signature

- Additional Remarks: Optional space for additional information on deductions, hourly cost of fringe benefits, or explanations.

- Signature of Certifying Official, Date, Telephone Number, and Email Address: The Statement of Compliance must be signed by the contractor or subcontractor, or their agent who paid or supervised the payment of the workers under the contract during the weekly time period covered by the form. Enter the phone number and email address of the individual who is signing the statement and the date signed. Legally valid electronic signatures are acceptable. A legally valid electronic signature includes any electronic process that indicates acceptance of the certified payroll record and includes an electronic method of verifying the signer’s identity. Note: Photocopies or scanned copies of signatures do not satisfy this requirement.

Getting Assistance with the WH-347

Verifying that all boxes are filled correctly to remain in compliance with the Davis-Bacon Act is only part of the compliance process. Having the supplemental documentation to prove that everything reported on the payroll form is the major key to confirming that prevailing wage payments have been met. Verifying proper completion for several weeks of payroll and a wide range of employees may be difficult, and enlisting a team to assist in reviewing documentation would alleviate the stress of reviewing paperwork. We’ll put you in touch with a team of prevailing wage experts who can meet you where you’re at with your current needs – whether it be education with prevailing wage trainings, as-needed support, or full project oversight from start to finish. Get in touch now to secure your projects.

Understanding California DAS Forms

The contents of this blog post have been partially transcribed from our YouTube series, “Apprenticeship Series”

California prevailing wage mandates the use of apprentices on public works projects. Amongst the apprenticeship requirements are the proper documentation practices. We’ll be uncovering the DAS (Division of Apprenticeship Standards) 140, 142, and 7 forms and how to maintain compliance with the apprenticeship requirements.

Table of Contents

- The DAS 140 Form

- Completing the DAS 140 Form

- Finding Apprenticeship Halls

- Which Box to Check

- DAS 140 Penalties

- The DAS 142 Form

- Apprenticeship Registration

- Completing the DAS 142 Form

- DAS 7 Form

The DAS 140 Form

The DAS 140 form is the “Notice of Award” form. So, it’s most applicable to contractors utilizing an apprentice-able craft. The document is meant to work as a notice to apprentice halls that you’re working on a prevailing wage project. Enforced by Labor Code 1777.5(e), the law states, “Before commencing work on a contract for public works, every contractor shall submit contract award information to an applicable apprenticeship program that can supply apprentices to the site of the public work.” For a step-by-step guide, you can visit this video on our YouTube channel, “How to Fill Out a California DAS 140 Form.”

Completing the DAS 140 Form

The top of this form should be filled out with all of your basic info. This includes:

• Your company name

• Your company’s address

• Project address

• Awarding agency’s address

• Your state license number

• Your company’s phone number

• The date your contract was executed

• The actual or expected date that your company will start on site

The remainder of the top half of the form requires that you list the following:

• The estimated number of journeymen hours being worked

• The occupation/craft being utilized

• The estimated number of hours you’ll have an apprentice work

• An estimate of the dates you plan to utilize them

• The apprenticeship program/hall the form is going to

Entering a “0,” “TBD,”, “N/A” or blank on the following boxes may invalidate the form. So, if you don’t have the exact dates or hours, it’s best practice to place an estimate.

Finding Apprenticeship Halls

Since this document goes out to all apprentice halls of each of your apprentice-able crafts, multiple versions of this may be filled out and sent. The website listed at the top of this form is where you’d find all halls that this form is to be sent to.

You can access this site here. Let’s do an example.

In our example, we are employing Laborers for a project located in San Diego County.

Once you hit “search,” a list of halls will pop up. Your DAS 140 form should go to all listed halls before you start on site. Even if the specific hall listed does not cover the scope of work you will be performing, the DIR still considers it to be applicable, and a DAS 140 form will still have to be sent.

Which Box to Check

There’s 3 options to choose from. Box 1, Box 2, or Box 3. Only one box should be selected.

Check off Box 1 if you’re signatory to a union hall and approved to train. Write the name of the union you’re signatory to on this line. If you’re checking box 1, then the DAS 140 would only have to be sent to this one hall.

Check box 2 if you are complying to a specific hall’s standards, paying your training to this hall, but are not approved to train. When you’re box 2, you will have to submit the DAS 140 to all halls listed on the DIR website.

If you check box 3, this means you will not be complying to any union’s standards and will be making your training payments for the listed classification to the CAC. You will also have to submit a DAS 140 to all halls listed on the DIR website.

DAS 140 Penalties

It’s crucial that this form is filled and sent out correctly, otherwise penalties of $300 per day, per classification may accrue, and that is a costly mistake.

The DAS 142 Form

The DAS 142 form is the “Apprentice Request Dispatch” form. For a step-by-step guide, you can visit this video on our YouTube channel, “How to Fill Out a California DAS 142 Form.” This form is utilized to help aid contractors in hitting a 20% apprentice ratio. Per CCR Title 8 Section 230.1, 20% of the workforce that you employ should consist of registered apprentices.

An apprentice is an employee who is undergoing an apprenticeship program approved by the Department of Apprenticeship Standards and is also registered in the state of California.

Apprenticeship Registration

If an employee is not registered with the state as an apprentice, they cannot be classified as an apprentice and must be paid the journeyman rate when working on a public works project. This discretion is also applicable if their apprenticeship status has expired by the time they’ve performed work on site. You can access this information using the DIR apprenticeship status lookup tool.

Completing the DAS 142 Form

The first section of this form outlines the website contractors can use to verify where the form can be sent. It also references the increments that you must hire an apprentice under.

In the second section, contractors must list the date, the applicable apprenticeship committee the form is being sent to, and your contractor information. If you checked box 2 or 3 on the DAS140, this form should be sent to the corresponding halls that your DAS 140 form was sent to.

In the third section, you must list the project information. If you have any questions regarding this portion of the form, please refer to your prime contractor.

The fourth section is the most important one. This is how the apprentice will know where to go and what time to show up. Let’s break it down.

The areas above are going to be filled out with two points in mind. First, the requested apprentice must be hired in 8 hour increments as referenced in Section 1. Second, the form must be sent 72 hours before the apprentice is needed as referenced in Section 5.

This 72 hour notice does not include weekends or holidays.

If this form is sent without these two criteria being fulfilled, it may be considered invalid. Underneath the dispatch request information, you should input the following:

• The number of apprentices needed

• The craft or trade they will work under

• The date and time they’re expected to report

• The name of the person they’re to report to on site

• The address of the project

It’s important to note that all information should be filled out accurately. Again, if any “0s,” “N/As,” “TBDs,” or blanks are located on the form, it may be considered invalid.

DAS 7 Form

Proof of approval to train apprentices includes an “approval to train” letter from your union, or a DAS 7 form.

The DAS 7 is a form intended to be filled out by the union hall verifying that your company is approved to train for the applicable craft. This form may be requested to verify that marking Box 1 on the DAS 140 form is accurate.

Contractors’ priority with this form is to ensure that it’s readily available to fulfill this request.

If you do not have this documentation, then your company may not be approved to train. With this, you may need to check Box 2 or Box 3 on the DAS 140 form to reflect an accurate status. For more information or resources, feel free to watch our Apprenticeship Series and contact us if you need further assistance.

The contents of this blog post have been transcribed from our YouTube video, “Guide Toward Davis Bacon Act Requirements & Best Practices.”

When working on a federally funded project, regulations are sensitive to keep up with. Failure to do so can result in costly penalties. Prevailing wage is a frequent standard to be in compliance with in federally funded projects, and the law that put this forth is the Davis Bacon act.

Table of Contents

- What is the Davis Bacon Act?

- What Projects are Applicable to the Davis Bacon Act?

- Who Is Owed Prevailing Wages?

- Where do I Find the Wages for my Project?

- Recordkeeping Requirements

- Apprenticeship Requirements

- Penalties

What is the Davis Bacon Act?

The Davis Bacon Act, also known as the DBA, is a rule applicable to federally funded projects that requires a minimum wage to be paid to workers, also known as the prevailing wage. This wage is consistent of a base hourly rate and fringe benefits. Alongside paying prevailing wages is the requirement to submit weekly certified payroll reports and maintain records. The Davis Bacon wages and posters should be posted on the site, easily visible to all workers. These requirements are applicable to all contractors within all tiers of the project, and penalties may be issued if in violation.

What Projects are Applicable to the Davis Bacon Act?

Applicability under the Davis Bacon Act is subject to a $2000 dollar threshold, so it is applicable to projects with a minimum of $2000 in overall project value.

The act is then in effect for the construction, alteration, or repair (including painting and decorating) of public buildings or public works. This is further defined under 29 CFR 5.2 under “Public building or public work.”

Who Is Owed Prevailing Wages?

As stated, prevailing wages are the minimum amount required to be paid out to workers on this project, referred to by the Davis Bacon Act as the “laborers or mechanics.” Laborers or mechanics includes “at least those workers whose duties are manual or physical in nature” as defined by 29 CFR 5.2. So, this excludes positions such as executive, professional or clerical, those commonly seen in administrative positions. The definition does include apprentices. Prevailing wages also applies only to workers performing on the site of work.

Where do I Find the Wages for my Project?

The DBA wages are posted on sheets known as “Wage Determinations” and are available online via sam.gov. The Wage Determination for your project includes a list of work titles, also known as classifications, and their corresponding wage rates.

The information you would need for your wage determination are your project’s Bid Due or Opening Date, the project County, State, and the project Construction Type.

Negotiated contracts would use the date of award. Competitively bid projects should look to the wage determination that was in effect 10 days prior to the bid opening date.

Here’s an example. Our project is competitively bid and had a bid due date of January 16th, 2024. The project is based in San Diego County, California, and has a “Heavy” construction type.

Upon inputting the applicable information onto the sam.gov site, you would click on the wage determination fit for your project. There may be multiple modifications

made. Our project had a bid due date of January 16th, 2024. Because we have to take the wage determination in effect 10 days prior to the bid due date to find our effective date.

10 days before January 16th would gives us an effective date of January 6th, 2024, which falls under Modification 0. Modification 0 is applicable for projects with effective dates from January 5th to January 11th.

If workers on your project are performing work that isn’t covered under the classifications listed on the Wage Determination sheet for your project, you have the option of submitting a SF 1444 Form, which is a request for an additional classification.

After finding your wage determination, proper wage payments should be issued to employees. While paying the base rate and fringe amount, other important things to look out for are footnotes or asterisks on your rate. This can include additional amounts required to be paid per classification or notices to changes in the rate.

Please note, there are no general frequent increases made to Davis Bacon wage determinations, and the rate found at the beginning of the project is grandfathered in during its entirety. However, local and federal minimum wage changes are to be taken into account.

Recordkeeping Requirements

The Davis Bacon Act requires submission of Certified Payroll Reports on a weekly basis. 29 CFR 5.5(a)(3) states that payroll records must include the following: the employee name, address, social security number, correct classification, hourly rate of wages paid, daily and weekly number of hours worked, deductions, and actual wages paid. The certified payroll report must also be signed under a “statement of compliance”, indicating that all its contents are accurate and cleared by the signer. A certified payroll report template issued by the U.S Wage and Hour Division contains these requirements for payroll reporting, known as the WH347 Form.

Alongside certified payroll reports, other documentation expected to be maintain includes additional records relating to fringe benefits and apprenticeship and training as applicable. Please note, additional recordkeeping is not limited to these types of documentation. Any form of record that displays the full picture of employees’ pay, or acts as “support” toward the payroll record would go toward this requirement.

Apprenticeship Requirements

Under 29 CFR 5.2, Apprentices are defined as “helpers” that are employed and individually registered in a genuine apprenticeship program. Apprentices are generally undertaking training and developing skills to excel within their occupation. If using an apprentice on your project, you must meet the following:

1) Verify that your apprentice is properly certified by a program registered with the Employment and Training Agency’s (ETA) Office of Apprenticeship (OA), or with a State Apprenticeship Agency recognized by the OA.

2) If counting apprenticeship costs as a fringe benefit, the costs must bear a “reasonable relationship” to benefits provided to workers.

3) The costs incurred for apprenticeship must not offset costs incurred for another classification.

4) Pay the appropriate wages including the percentage of hourly rate required by the apprenticeship or training program and the approved program fringe benefits.

5) Utilize apprentices in accordance with the program-issued ratio of permitted apprentice to journeyman performing oversight.

To find the proper rates or wages to pay your apprentices, it’s best practice to consult with the program or union that you intend to utilize apprentices from to verify the rates they enforce. The Davis Bacon Act does not establish wage rate for apprentice-level workers.

Penalties

It’s vital that these requirements are met to avoid the potential penalties that come with violation. These penalties include:

1) Suspension of funds and withholding (29 CFR 5.9(a))

2) Debarment for breach of contract clauses under the requirements listed for this act (29 CFR 5.5(a)(7))

3) Restitution for unpaid wages and liquidated damages under CWHSSA (29 CFR 5.5(b)(2))

4) Withheld funds for unpaid wages and liquidated damages (29 CFR 5.5(b)(3))

Further penalties may be imposed for additional violations found, and enforcement is held by the Division of Labor in which violations are evaluated for the appropriate remedial action.

Avoid paying restitution interest, facing debarment, and encountering criminal action amongst other penalties by remaining informed and compliant with the Davis Bacon Act requirements.

Tune into the remainder of this series where we uncover updates made to the Davis Bacon Act known as the “final rule.” These updates provide context to the items we’ve discussed in today’s video and provide additional information in remaining compliant.

To get a full picture on prevailing wage, you can watch this video for a full overview. Have any further questions? Let’s get in touch.

Classifying Employees (Davis-Bacon)

Proper classification of employees is a principal point in remaining in compliance with federal regulations. Here’s a breakdown of what “classifications” are and how you use them.

- What is a Classification?

- How to Classify an Employee Under Prevailing Wage

- Best Practice for Classifying an Employee on Payroll

- What are the Effects of Misclassifying Employees?

- Conclusion

What is a Classification?

A “classification” is an identifier or title signifying the skill, work, responsibilities, and duties of an employee. Classifications serve as a way of categorizing your employee, and this aids in defining things such as job roles and wage rates. Other commonly exchanged terms in the realm of classifications include “trades” or “crafts.” The term “craft” is used synonymously alongside “trade” and means “an occupation requiring manual skill.”

How to Classify an Employee Under Prevailing Wage

Employees should be classified based on their scope of work. An employee’s scope of work description would include the skills, tasks, machines/tools being used, and even materials being handled. The Wage and Hour Division (WHD) publishes the prevailing wage rates covered under the Davis Bacon Act that includes a list of classifications and the rates owed. These can be found at sam.gov. Here are the main steps to keep in mind as you complete your search:

1) The following are used to find your Davis Bacon project’s wages:

a. Your project’s state

b. Your project’s county

c. Construction type

d. Your project’s bid advertisement date (alternately, the contract award date)

Entering this information onto the wage determinations page should generate the applicable wages for your project.

The classifications within the wage determination are listed with a union code identifier above the classification title. This may look like this:

This identifier points to the union that was surveyed to retrieve the classification’s rates. Please note, you do not need to be signatory to a union for this to be applicable. The union within the identifier could be referred to for the scope of work description or comprehensive list of tasks that would be performed by its corresponding classification. As previously mentioned, this would include the main identifiers that would align with whatever skills, tasks, machines/tools being used, or material being handled by your employees. Common classifications can include Laborers, Carpenters, or Electricians. If you’d like to contact the union to find their scope of work description, you can decipher what union is listed with the following indicators:

• A four-letter abbreviation of the classification

• The local union number following the abbreviation

From the above screenshot, the listed union would be the Laborers Local 89.

There are no established nationwide standard classification definitions under the Davis Bacon Act, so contractors are encouraged to examine “local area practice.” Thus, the act refers to the Wage and Hour Division (who publishes the wage determinations) and/or local construction industry stakeholders for determining the classification of your employees (scope of work assigning assistance).

Best Practice for Classifying an Employee on Payroll

When reporting on payroll, it’s best practice to classify employees based on the work they performed within the day. This affects how an employee appears throughout the week if they are skilled in several trades and certified to perform different types of work – they might be used to complete a variety of tasks across the project. So, they should be classified as such. Keeping timecards and descriptions of the work completed can assist with recordkeeping.

Let’s use some of the previously listed common classifications as an example.

If an employee were performing tasks exclusive to Laborers on Monday and were then performing tasks exclusive to Carpenter on Tuesday, the employee would be reported as the Laborer classification on Monday and the Carpenter classification on Tuesday.

This is additionally important to note because of the difference in required wage rates to the classifications. If an employee were listed as a Classification A and receiving the wages assigned to Classification A but were actually performing the tasks of a Classification B, a classification with a higher wage rate, the contractor may be subject to penalties for misclassification and underpayments.

What are the Effects of Misclassifying Employees?

The Wage and Hour Division closely examines the classification of employees. A common mistake in classifying employees is assigning an “independent contractor” status. In a recent case based in Alabama, an aviation maintenance shop was reported misclassifying employees as independent contractors. The Department of Labor recovered $127,249 back in wages from this case.

Conclusion

Classifications help in standardizing work across the industry. Maintaining records of the scope of work performed by your employees and classifying them appropriately prevents contractors from misclassifying employees and potential underpayment penalties.

Have any further questions? Let’s get in touch.

California AB 2143 Overview

The contents of this blog post have been transcribed from our YouTube video, “California’s New Solar Regulation and Requirements: AB2143”

Renewable energy is taking the construction space by storm and keeping up with regulations can be a tough feat, but we’re here to help. We’ll be discussing changes made to California’s net energy metering program that came into effect January 1st, 2024 in this overview of Assembly Bill 2143, also known as AB 2143.

Table of Contents

- Net Energy Metering Explained

- Applicability and Requirements

- Paying Prevailing Wages

- Maintaining and Verifying Payroll Records

- Biannual Payroll Submissions

- Penalties

- Exemptions

- Conclusion

Net Energy Metering Explained

Net energy metering is a tool that allows customers with renewable energy systems, namely solar panels, to gain credit for solar projects exceeding 15 kW of energy generated that is fed back into the grid. So, extra energy gathered from a renewable energy source can be sold for credit.

Applicability and Requirements

AB2143 is applicable to contractors entering into a contract to perform work on a renewable electrical generation facility or associated battery storage.

The requirements include:

• Paying Prevailing Wages

• Maintaining and Verifying Payroll Records

• Submitting digital copies of payroll records biannually

Paying Prevailing Wages

Prevailing wages are the minimum rate required to be paid out to workers in a specific occupation, also known as a classification. California prevailing wage rates are issued by the Department of Industrial Relations, also known as the DIR. Not only are there required base rates assigned to each occupation type, but there are also fringe amounts and provisions that can differ per classification. For an in-depth review on prevailing wage, you can visit this video on our YouTube channel.

Maintaining and Verifying Payroll Records

The second requirement is the requirement to Maintain and Verify Payroll records. Payroll records must be accurate and display the following:

• Employee name

• Address

• Social security number

• Work classification

• Straight time and overtime hours worked each day and week

• Actual wages paid

They must also be signed under penalty of perjury, which is a legal statement by the signer verifying that all information on the payroll record is true.

These payroll records must also be available for inspection or furnished upon request to the awarding body and Division of Labor Standards Enforcement, also known as the DLSE.

Biannual Payroll Submissions

Finally, each contract must submit digital copies of certified payroll records biannually. The dates for submission are July 1st and December 31st of each year. The commission team that monitors Net Energy Metering projects will be retaining these records as public record for five years.

So, to summarize the key points, prevailing wages must be paid at minimum to employees on renewable energy projects, payroll records of these wages must be kept and available upon inspection or request, and records must be submitted biannually.

Penalties

While the requirements can be vast, violation of the requirements can pose major issues. AB 2143 is enforced through the following means:

A civil wage and penalty assessment can be issued. So, if a contractor is found to be in violation, interest will accrue on all due and unpaid wages and the violator will be publicly listed by The Labor Commissioner. Construction workers cannot be underpaid and administrative complaints or civil action can be pursued for violation of the bill.

Additionally, willful violation can result in revoked eligibility for the energy facility to receive service pursuant to AB 2143 Section 769.2(d).

Exemptions

Please note, this bill is not applicable to the following (as derived from AB 2143 Section 769.2(f)):

“

• A residential renewable electrical generation facility that is eligible to receive service pursuant to the standard contract or tariff developed pursuant to Section 2827.1 and has a maximum generating capacity of 15 kilowatts or less of electricity.

• A residential renewable electrical generation facility that is eligible to receive service pursuant to the standard contract or tariff developed pursuant to Section 2827.1 and that is installed on a single-family home.

• A project that is a public work, as defined in Section 1720 of the Labor Code, and that is subject to Article 2 (commencing with Section 1770) of Chapter 1 of Part 7 of Division 2 of the Labor Code.

• A renewable electrical generation facility that serves only a modular home, a modular home community, or multiunit housing that has two or fewer stories.

“

Conclusion

With everything discussed in mind, it’s important to be aware of and comply with the requirements of AB2143. Our team works closely with contractors through dozens of project types to assist in remaining compliant. If you would like in-depth assistance, please feel free to get in touch.

The contents of this blog post have been transcribed from our YouTube video, “New York Roadway Excavation Quality Assurance Act Overview”

A New York Labor Law published in August of 2023 has triggered prevailing wage requirements on certain roadway construction work by utility company contractors. Here’s an overview of what this act is and what requirements are posed for you.

Table of Contents

- Which Projects are Applicable?

- Prevailing Wage Requirements

- Recordkeeping Requirements

- Enforcement and Penalties

- Conclusion

Which Projects are Applicable?

The New York Roadway Excavation Quality Assurance Act came into effect on September 15th, 2023. The rules under this law are enforced on “all contracts for construction solicited on or after the effective date.” A contract is “solicited” when bidders on a project are requested to submit their offers. If there was no solicitation or contract, the act is enforced on work performed under a permit issued on or after the effective date. If a permit was required for the job but not obtained, the work would still be covered.

The type of work covered under this law is defined as a “covered excavation project.” This includes “construction work issued to a contractor or subcontractor of a utility company by the state, a county, or a municipality.” The work covered isn’t exclusive to excavation, and the law generally covers “projects requiring a permit to excavate, open, or otherwise use a street to perform utility work are covered by this law.” This can include the opening, patching, and closing of the street as well.

Covered types of utility work include “Electric, gas, water, steam, sewer, fuel, geothermal and telephone/telegraph.

Prevailing Wage Requirements

With the effective date and types of covered work in mind, the payment of prevailing wage rates would follow. The payment of prevailing wages is applicable to all contractors and subcontractors and would go to the laborers, workers, or mechanics performing work for the utility company, For an extensive overview of what prevailing wages are, you can visit this video on our YouTube channel.

Contractors are recommended to contact the nearest Bureau of Public Work district office to gather which prevailing wage rates are applicable to the different types of utility work.

Recordkeeping Requirements

Alongside the payment of prevailing wages, contractors are instructed to maintain records of payment. Per the Quality Assurance Act guidance, “Contractors and subcontractors to a utility are now always required to keep records of the payment of prevailing wages.” Commonly kept records for general prevailing wage documentation includes certified payroll reports, pay stubs/itemized wage statements, and fringe benefit documentation. The overarching best practice is to keep all documents that provide a full picture of the employees’ pay.

Enforcement and Penalties

Regulations of The Quality Assurance Act and penalties for violation are further defined through the following Labor Laws:

Labor Law 220, which defines the 8 hour workday,

Labor Law 220(a), which requires contractors to maintain statements showing the amounts due for wages toward employees and the payment of prevailing wages.

Labor Law 220(b), which defines withheld payments on laborers’ wages,

Labor Law 223, which defines the contractor’s responsibility if found non-compliant with the proper payment of wages

Labor Law 224-b, which defines the stop-work order if a contractor is found to be non-compliant,

And Labor Law 227, which penalizes contractors who have failed to pay prevailing wage rates. This can result in being guilty of a misdemeanor and, in certain cases, a fine of $500 – even imprisonment.

Conclusion

The payment of prevailing wages under the New York Roadway Quality Assurance Act is important to maintain to keep your business above penalties and remain in compliance with the prevailing wage laws.