-

How to Fill Out a California DAS 140 Form

One of the most common errors we see from contractors is incorrectly filling out California apprentice forms. In this video, we'll walk you through the steps for filling out a California DAS 140 form, from start to finish. We'll cover everything from when the form is required, how to properly fill out each field, and how/where to submit it once you've completed the form. Not meeting this Apprentice requirement can lead to costly penalties. Come join us and learn how to avoid common mistakes.

-

How to Fill Out a California DAS 7 Form

Contractors are required to have a California DAS 7 form readily available in the event of an audit. If you are unsure how to fill out the form or could use a refresher, this video provides a step-by-step guide!

-

How to Fill Out a California DAS142 Form

This video provides a comprehensive tutorial on completing the California DAS142 Request for Dispatch of an Apprentice form. Our goal is to make the process of filling out this form quick and effortless for contractors. The California DAS 142 form is used when you need to request an apprentice to be dispatched for your upcoming job. Satisfaction of the Apprenticeship Requirements may not be met if this form is not accurately filled out and submitted. This video is for those who could use some guidance on filling out the form, or just need a reminder.

-

Making Payments to the California Apprenticeship Council

Contractors are required to pay a training fee on California Prevailing Wage projects, and, if not subject to a union, can expect to make payments to the California Apprenticeship Council. We'll be going through how to make CAC payments, how to calculate how much you owe, and handy documentation/resources to help you meet this requirement. If you need some assistance and could use a walk through of the process, check out this video!

-

Need-to-Knows: Apprenticeship Certification

Apprentices are utilized on California public works projects by contractors, and it's important to ensure that the apprentices being utilized have proof of apprenticeship to avoid potential misclassification violations. In this video, we cover what an apprentice is, when apprentices are required, and how to check if an apprentice is certified using the DIR lookup tool. If you have been struggling with any of these, or you could benefit from an overview, check out this video!

-

Inflation Reduction Act (IRA) Overview

In this video, we explore the key aspects of the Inflation Reduction Act and its implications for contractors. The IRA has introduced Prevailing Wage and Apprenticeship requirements that will impact your upcoming projects. It is important that you are aware of these requirements and understand how to comply to ensure the additional tax credit is captured and you avoid penalties. The IRA aims to address the climate crisis while providing economic opportunities. Additionally, it adds increases to tax incentives for both corporate and private entities transitioning towards eco-friendly practices.

-

Inflation Reduction Act (IRA) Overview - Wage Determination

In this week's video, we present part two of our series! We delve into the topic of wage determination under the IRA. Join us as we explore who the IRA applies to, qualifying facilities, and wage & apprenticeship requirements. These essential insights will not only help you avoid costly penalties, but also ensure compliance with the regulations, keeping your project on track.

-

Inflation Reduction Act (IRA) Overview - Apprenticeship Requirements

To conclude this series, we share our best practices for employing apprentices and cover the three essential apprenticeship requirements; all of which must be met to qualify for increased tax benefits under the IRA and avoid costly penalties.

-

What is Prevailing Wage?

This will be the first of our 'Frequently Asked Questions' series. In this video we answer the question, "What is Prevailing Wage?" Having an understanding of prevailing wage and its requirements is crucial when avoiding penalties. Alliant is here to help as we take you point by point, from the definition of prevailing wage to the different labor codes involved.

-

What are Fringe Benefits?

To continue our Frequently Asked Questions series, we cover the different aspects of fringe benefits and why they are important. Knowing what qualifies as a fringe benefit and how to factor them into prevailing wage payments can help save you money and prevent penalties! If you could use an overview of fringe benefits, check out this video!

-

What are Authorized Payroll Deductions?

The latest video in our Frequently Asked Questions series is here. Together, we discuss the best practices for handling deductions from your employees' payroll. From maintaining proper documentation to calculating employee benefits, Alliant is here to help!

-

How to Pull a Wage Determination

In continuation with our Frequently Asked Questions Series, our newest video answers the question "How Do I Pull a Wage Determination?" This video covers everything you need to know from classifications to the full determination process.

-

California's New Solar Regulation and Requirements: AB2143

In this video, we take a dive into Assembly Bill 2143, also known as AB2143, California's new regulation that came into effect this year. This bill issues the requirement to pay prevailing wages and outlines new rules on earning net energy metering credits. Get educated on how the renewable energy industry is getting shifted and how solar companies can avoid penalties by remaining compliant.

-

New York Roadway Excavation Quality Assurance Act Overview

In this video, we uncover new requirements for contractors completing utility services on roadways. This new Assembly Bill issues the requirement to pay prevailing wages and maintain records. It's best practice to remain in accordance with these regulations to avoid penalties.

-

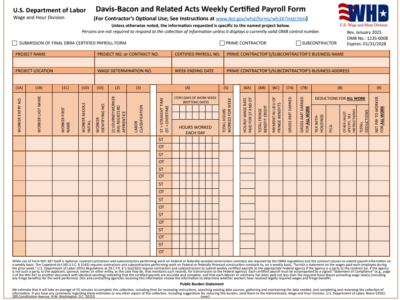

Guide Toward Davis Bacon Act Requirements & Best Practices

If you're working on a federal project, it's important to remain informed on the requirements that come with accepting these funds for construction. Factors like paying prevailing wages and maintaining records are a major key to compliance. Avoid penalties and keep yourself up-to-date with the Davis Bacon Act and its requirements.

-

The Newest Updates to the Davis Bacon Act Definitions

The Davis Bacon Act established federal requirements for construction projects, and the payment of prevailing wage is vital in remaining compliant. This law has served as a foundational act and has undergone changes throughout the years. Most recently, the Department of Labor (DOL) released the Davis Bacon Final Rule, covering updates of different categories to the original Davis Bacon/Davis Bacon and Related Acts. Our series uncovers all the different components to this Final Rule and what it means for those affected.