Table of Contents

- Introduction

- Basic Information Section

- Employee Information Section

- Work Week Hours

- Payment Section

- Notice and Public Burden Statement

- Page 2

- Authorized Certifier Information

- Certifications

- Additional Remarks and Signature

- Getting Assistance with the WH-347

Introduction

The WH-347 form is a weekly certified payroll report template for contractors to use on projects subject to the Davis-Bacon and related Acts. While the use of the form itself by contractors is optional, it contains information that is required to be maintained under the Davis-Bacon Act, and its use can ease the payroll process.

The form was recently revised, and knowing how to properly complete the form with the changes in mind is key to verifying that you are compliant with the DBA payroll reporting requirement. Walk through the major differences side by side and how to complete each section below.

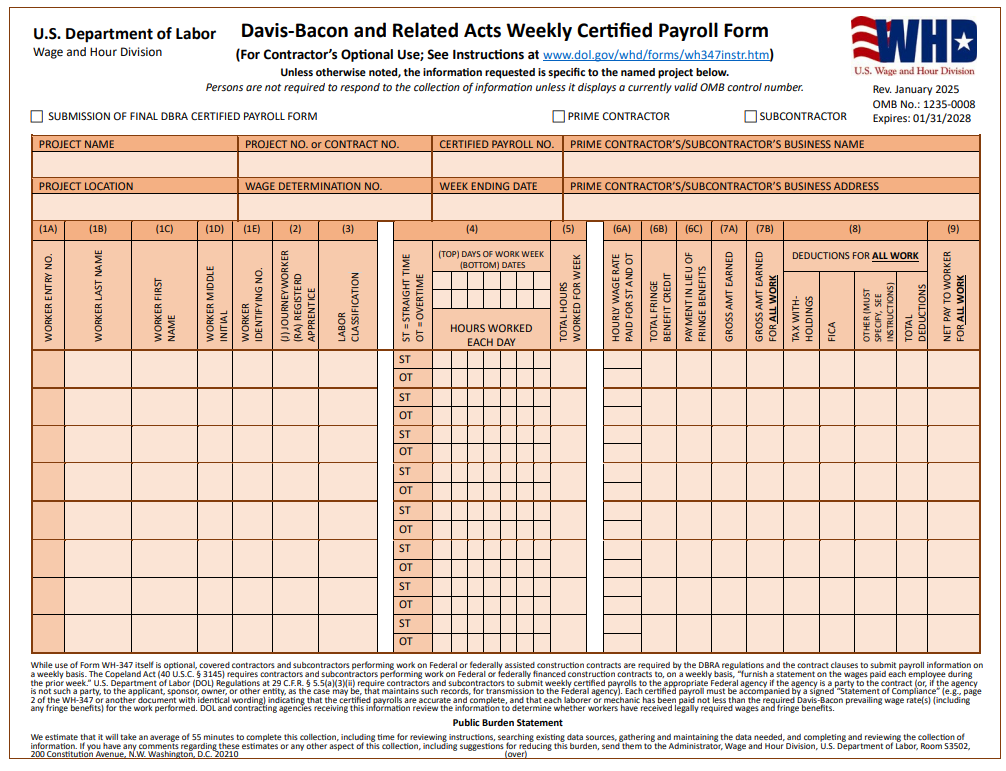

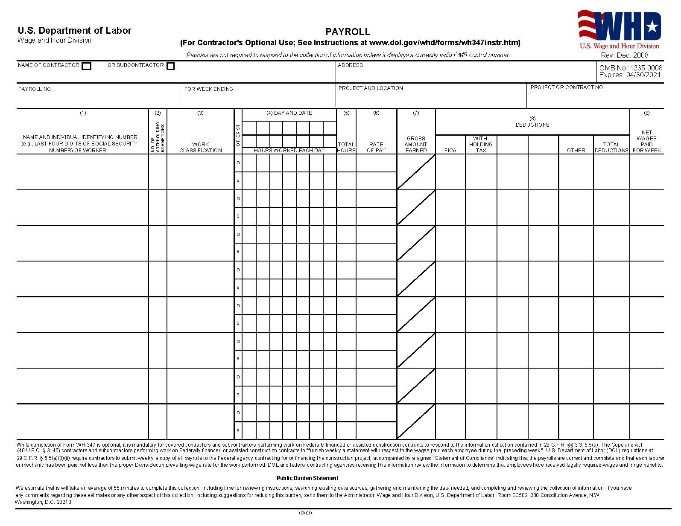

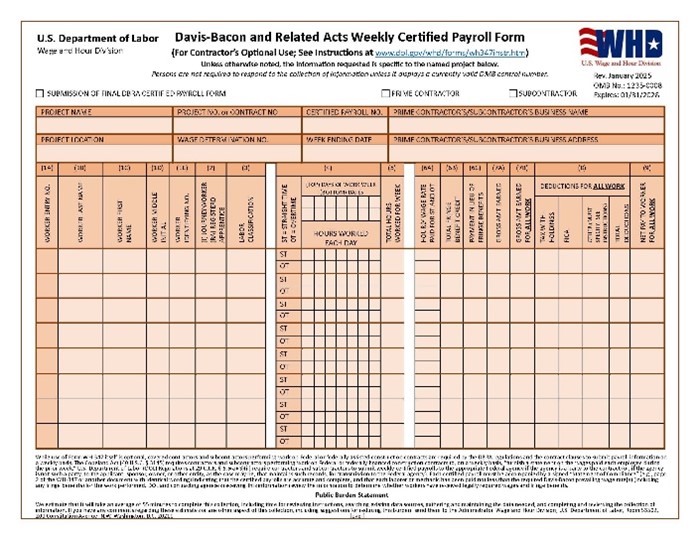

Old WH-347 |  New WH-347 |

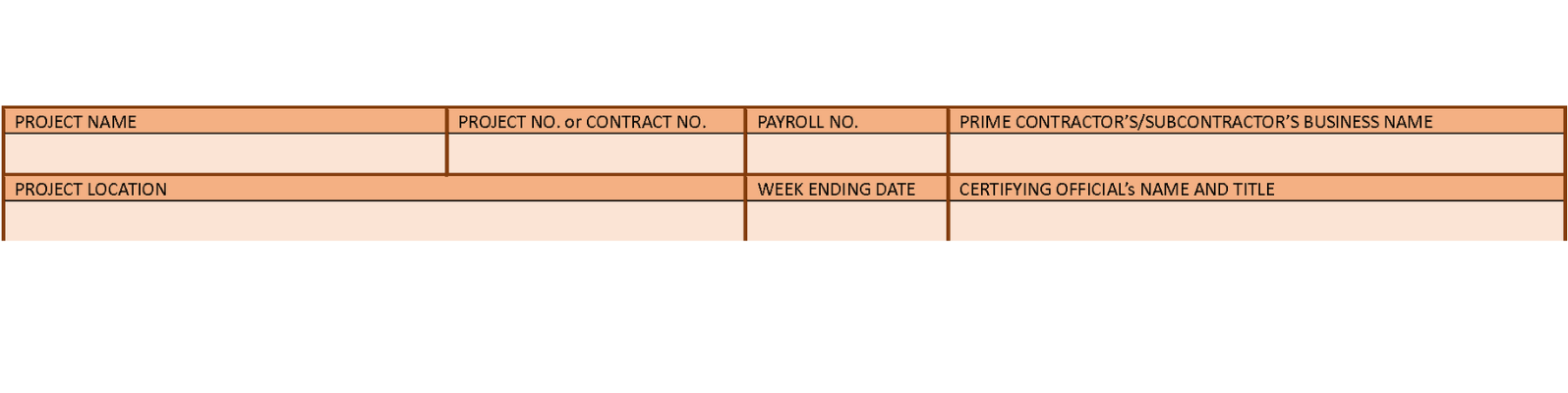

Basic Information Section

The “Basic Information” section containing basic info about the contractor, project, and payroll have taken a new table format. All information on the old form still remains on the new one, with the new addition of the “Wage Determination No.”.

Old WH-347 |

New WH-347 |

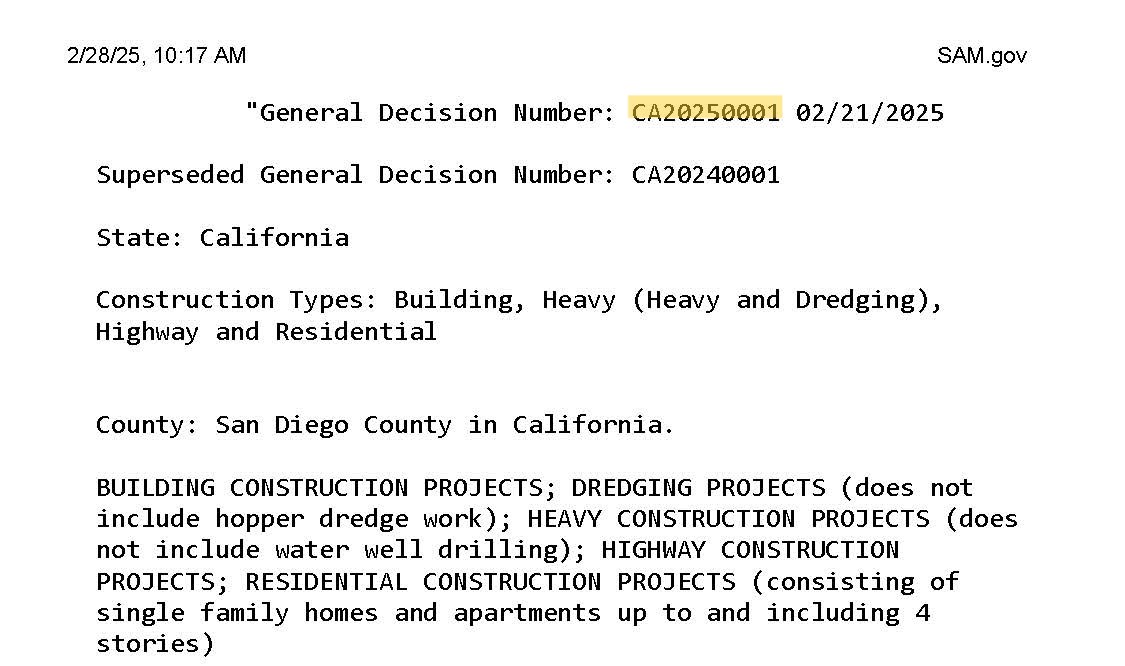

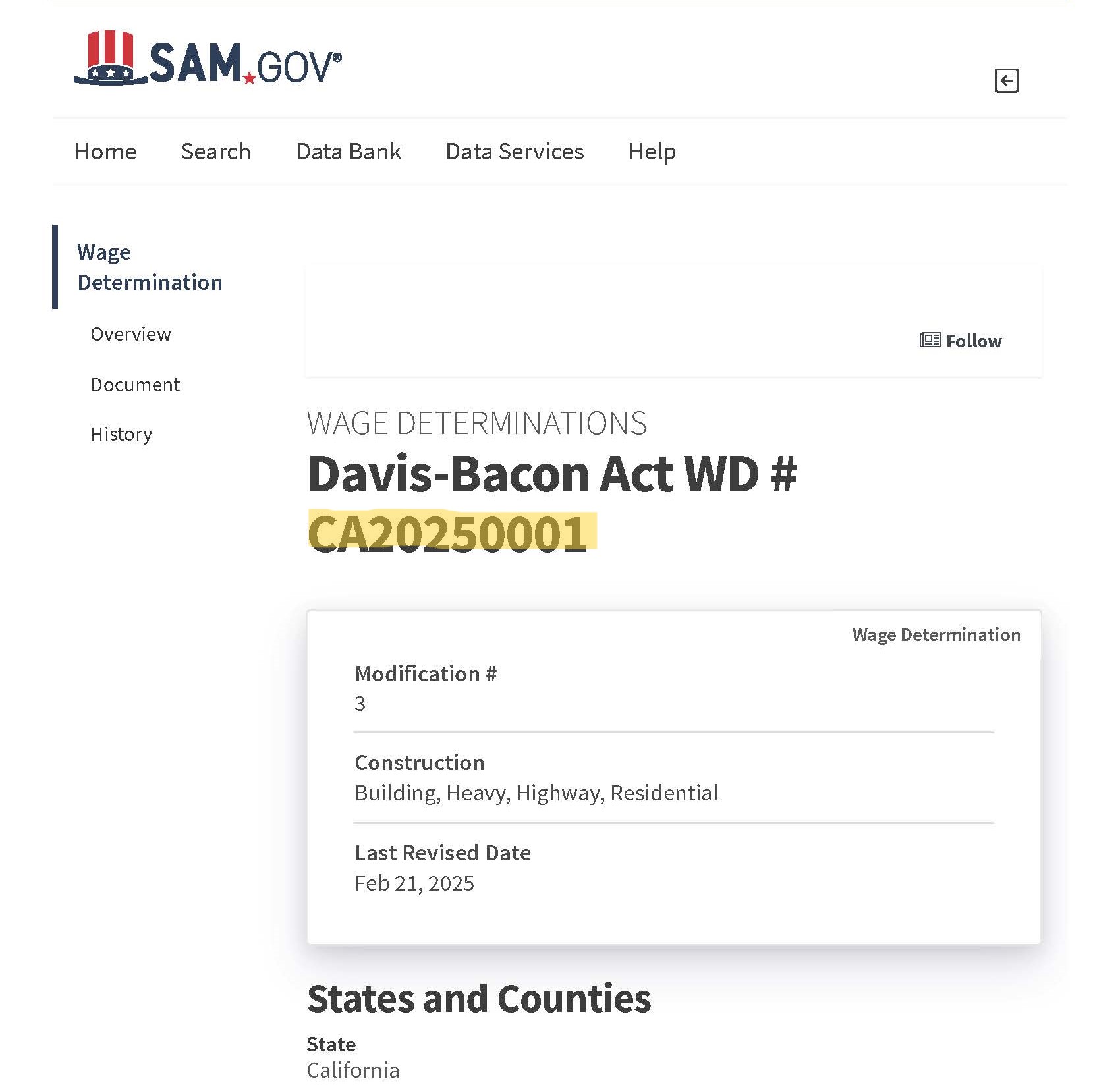

- Wage Determination No. – DBA projects have a “Wage Determination” set for the project, which is a list of applicable wages and fringe benefits for all trades that would be on the project, dependent on factors like the Contract Award Date and project location. The Wage Determination No. would be the General Decision Number found at the top of your wage determination page

The remainder of the information on the Basic Information includes:

- Project Name

- Project Location: The address of the project site.

- Project No. or Contractor No.

- Certified Payroll No.: A sequential number for the week’s submission. For example, if this is the first payroll, the Certified Payroll No. would be 1. For the following week, it would be 2, etc.

- Week Ending Date: The date of the last day of the recorded pay period. For example, if a payroll week ran from 2/10/25 – 2/16/25, the week ending date would be 2/16/25.

- Prime Contractor’s/Subcontractor’s Business Name: Your business name.

- Prime Contractor’s/Subcontractor’s Business Address: The address of your business location.

Employee Information Section

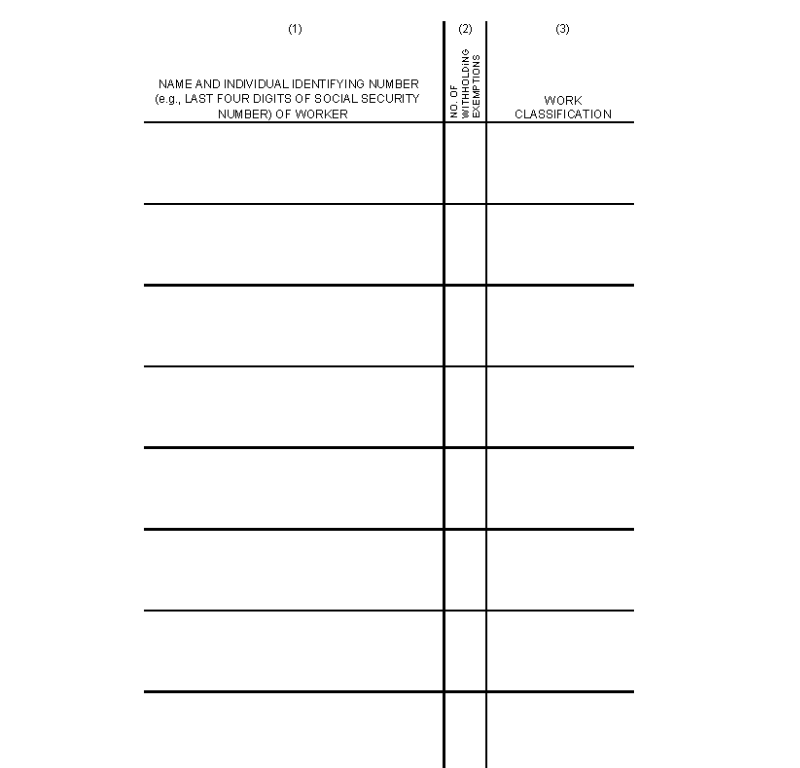

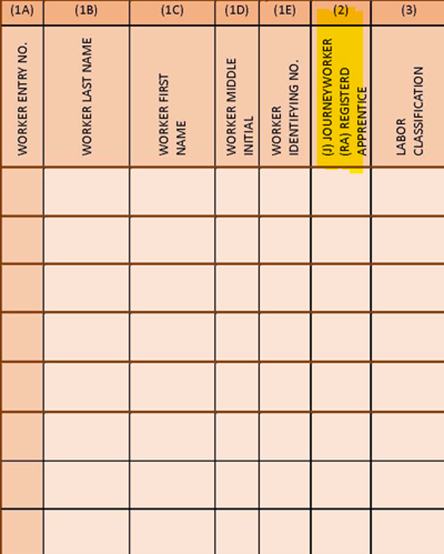

Old WH-347 |  New WH-347 |

The information under Column 1 of the old form has been broken out into separate columns of the new form. The No. of Withholding Exemptions column from the old form was removed, and the (J) Journeyworker (RA) Registered Apprentice column and Worker Entry No. columns were added.

- (J) Journeyworker (RA) Registered Apprentice: Write in J if the employee is a journeyworker. Write in RA if the employee is a registered apprentice, meaning they are undergoing an apprenticeship program with a registered institution.

- Worker Entry No. – The sequential number of the employee listed. For example, the employee listed in the first row would be Entry No. 1, the second would be 2, etc.

The remainder of the information maintained in this section includes:

- Worker Last Name

- Worker First Name

- Worker Middle Initial

- Worker Identifying No.: A unique identifier, such as the last four numbers of their Social Security Number or an employee ID number.

- Labor Classification: The classification or trade title as it correlates with the one listed in the wage determination. Examples include Carpenter, Electrician (Cable Splicer), Operator: Power Equipment (Tunnel Work) Group 3, etc.

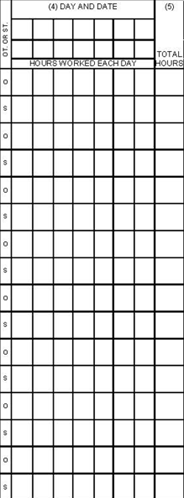

Work Week Hours

Old WH-347 |  New WH-347 |

All areas under this section remain the same, with a few slight positioning adjustments of the Straight Time and Overtime hours.

- Days of the Work Week

- Top: Ex. M, Tu, W, Th, F, Sa, Su

- Bottom: Ex. 2/10, 2/11, 2/12, 2/13, 2/14, 2/15, 2/17

- Work weeks aren’t required to occur on a Monday – Sunday structure and would follow the date range of your pay period.

- Hours Worked Each Day

- ST (Straight Time) – Number of hours worked at a regular, non-overtime rate for each day.

- OT (Overtime) – Number of hours worked past the straight time rate for each day.

- Total Hours Worked for Week

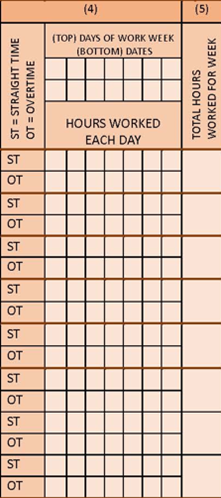

Payment Section

Old WH-347 |  New WH-347 |

All areas from the old form were maintained with the addition of two new columns, the Total Fringe Benefit Credit column and the Payment in Lieu of Fringe Benefits column.

- Total Fringe Benefit Credit – The total gross fringe benefit credit earned across all hours worked within the week. Ex. $20 in fringes x 30 hours = $600

- Payment in Lieu of Fringe Benefits – The cash amount a worker earned instead of fringe benefits. This is separate from the base rate earned in cash.

The remaining fields include:

- Hourly Wage Rate Paid for

- ST (Straight Time): The hourly straight time rate the worker is being paid in accordance with their classification.

- OT (Overtime): One and a half times the base hourly rate.

- Gross Amount Earned: The sum of all earnings across the base hourly rate and fringes for the project.

- Gross Amount Earned for All Work: The sum of all earnings across the base hourly rate and fringes for all projects this employee is contracted on that would reflect the pay stub.

- Deductions for All Work:

- Tax Withholdings: All applicable taxes, including those that are mandated federally, locally, etc.

- FICA: Federal Insurance Contributions Act – federal social security and Medicare contributions.

- Other: All other potential deductions authorized by the employee. If the amount is specific to a single deduction, it must be described under the “Additional Remarks” on page 2 of the form. If there are several deductions under the “other” category (ex. life insurance, pension, etc.), an addendum must be submitted that itemizes each deduction with a description and amount for each.

- Total Deductions: The sum of all deductions.

- Net Pay to Worker for All Work: The actual dollar amount paid to the worker for all hours worked across all projects during the week.

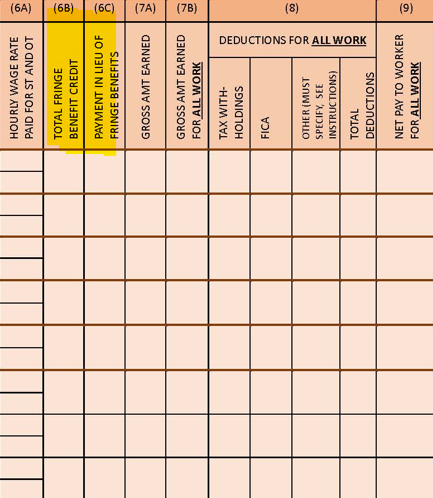

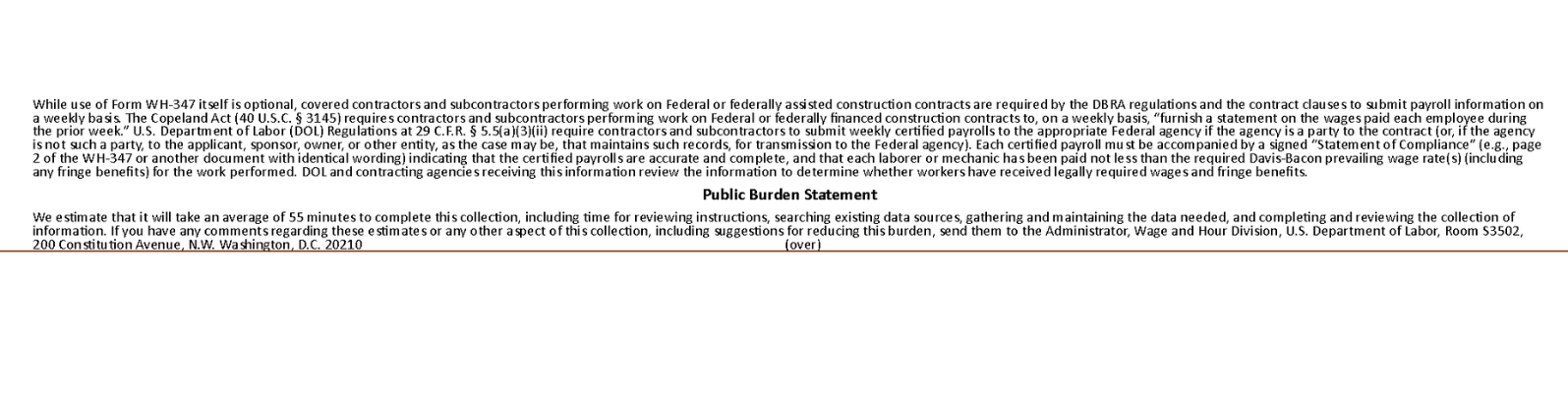

Notice and Public Burden Statement

Old WH-347 |

New WH-347 |

The statement at the bottom of the page has been revised, but the basis of the content includes:

- The Requirement to Submit Payroll Weekly (The Copeland Act (40 U.S.C. § 3145)

- The Requirement to Include All Required Information on Payroll (29 C.F.R. § 5.5(a)(3)(ii))

- The Requirement to Sign a “Statement of Compliance”, Noting That Payroll is Accurate Under Penalty of Perjury

- Acknowledgment of Time Commitment Required to Complete Form

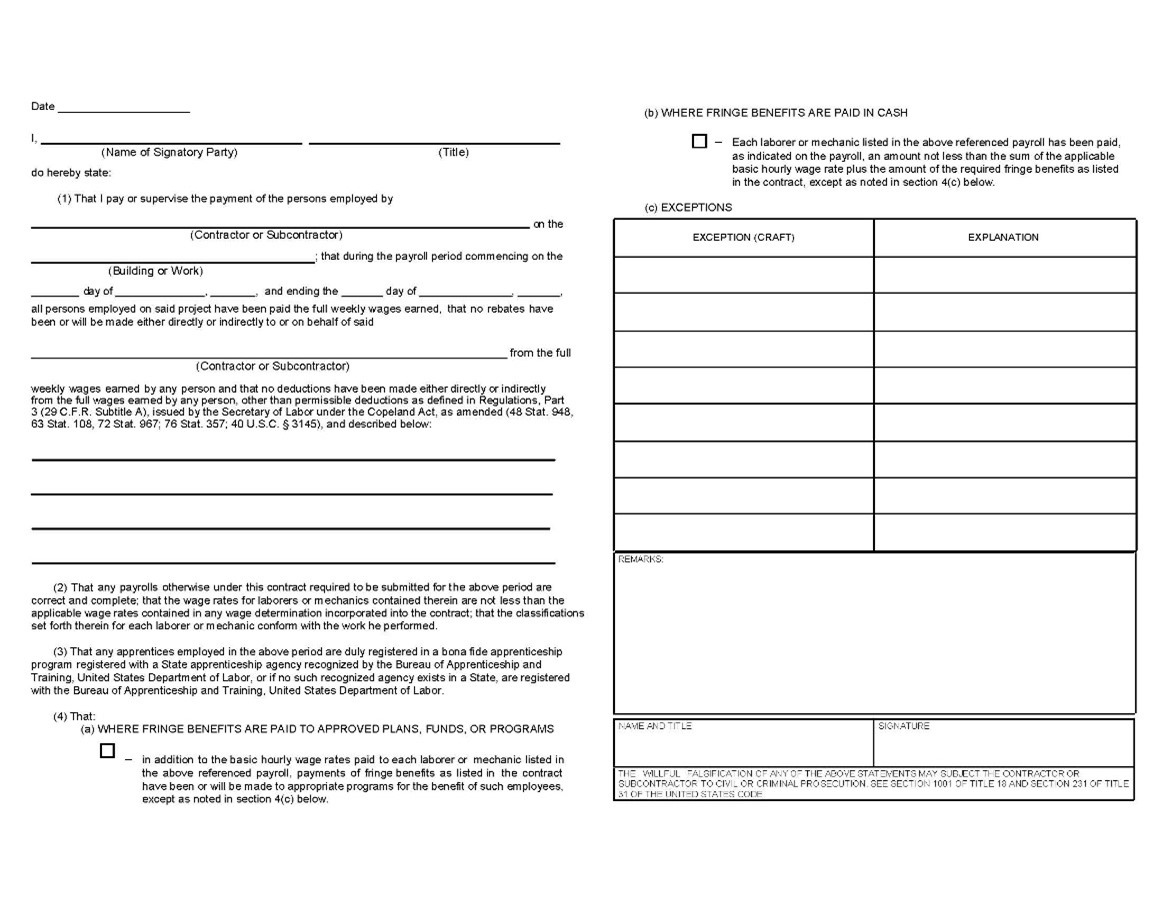

Page 2

The second page of the WH-347 received a complete revamp:

Old WH-347 |

New WH-347 |

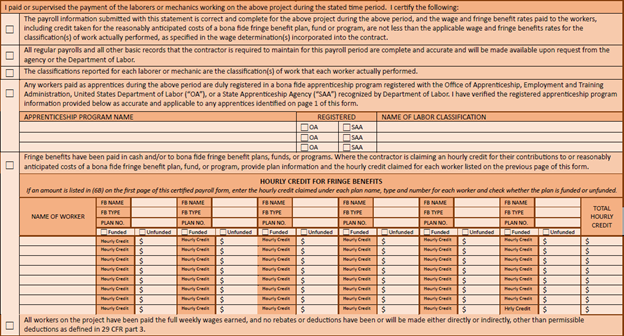

Both versions contain a Statement of Compliance, but the second version separates the statements with certifications of Proper Payment, Accurate Payroll and Obligation to Supply Records, Work Performed, Apprentices, Fringe Benefits, and Deductions.

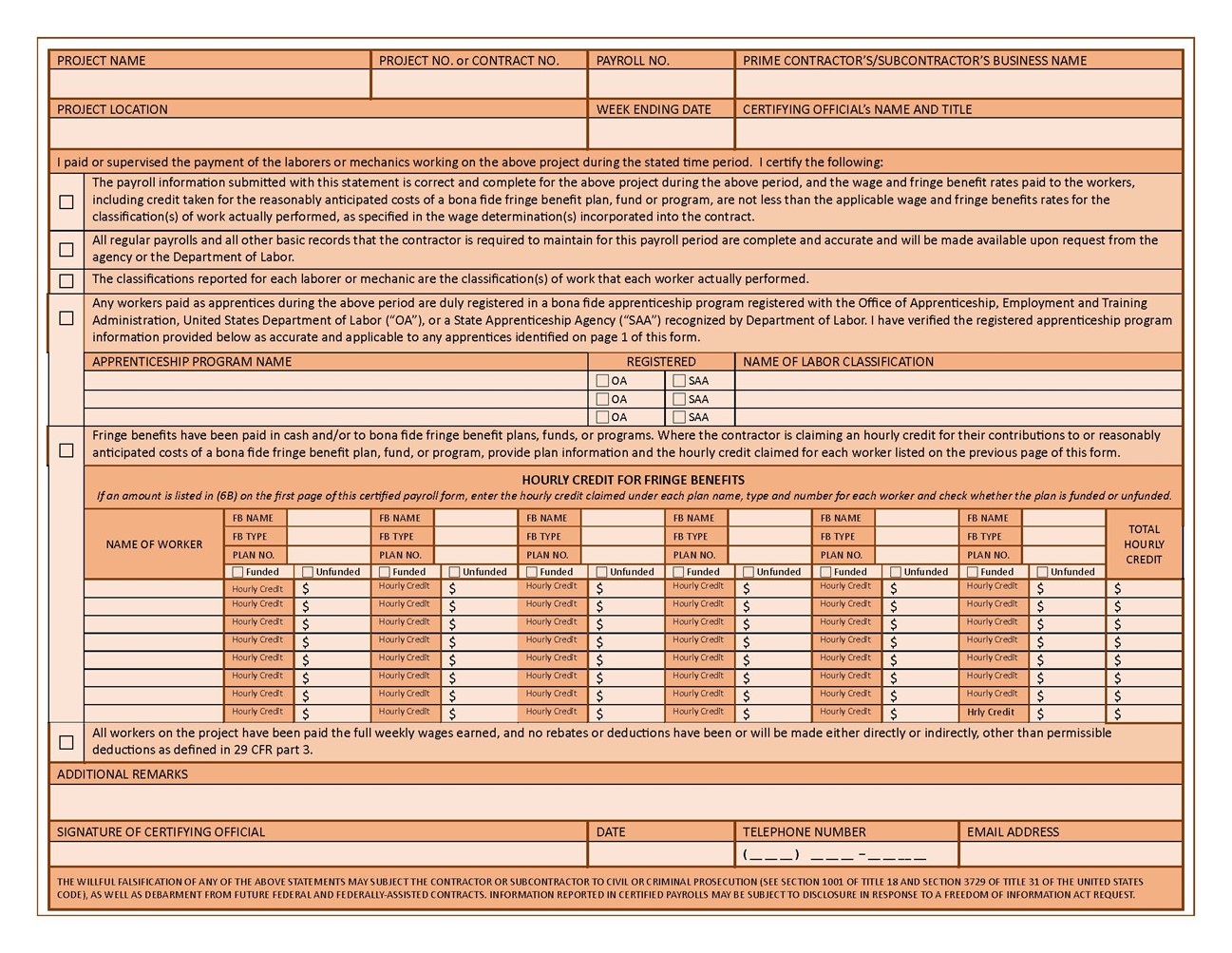

Authorized Certifier Information

- Project Name

- Project Location

- Project No. or Contract No.

- Payroll No.

- Week Ending Date

- Prime Contractor’s/Subcontractor’s Business Name

- Certifying Official’s Name and Title – This individual should verify that they were given authorization by a party to certify all information included on the payroll report. Their name and title/position should be written in.

Certifications

- Box 1, Certification of Proper Payment

- Box 2, Certification of Accurate Payroll and Obligation to Supply Records

- Box 3, Certification of Work Performed

- Box 4, Certification of Apprentices: If apprentices are employed during the work week, the programs that they’re registered under, the body that the program is registered with, OA (DOL’s Office of Apprenticeship) or SAA (State Apprenticeship Agency), and the name of the labor classification working.

- If not applicable, leave the box unchecked and enter “N/A” under the blank sections.

- Box 5, Certification of Fringe Benefits

- If you’re claiming an hourly credit for contributions to benefit plans, funds or programs, this box should be checked with the following information completed:

- Name of Worker

- FB Name: Fringe Benefit Name (Ex. Anthem)

- FB Type: Fringe Benefit Type (Ex. Health Insurance)

- Plan No.

- Funded or Unfunded

- Hourly Credit

- Total Hourly Credit

- Per the DOL, if more than six bona fide fringe benefits are provided to the workers for which the contractor is claiming a credit, submit an addendum for each providing the information requested in this section.

- Box 6, Certification of Deductions

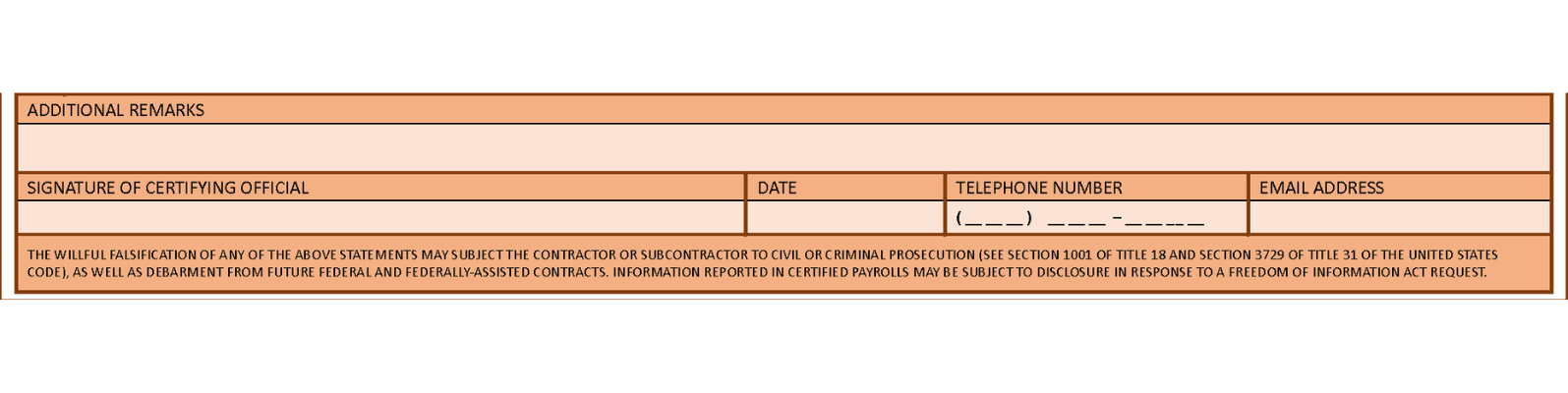

Additional Remarks and Signature

- Additional Remarks: Optional space for additional information on deductions, hourly cost of fringe benefits, or explanations.

- Signature of Certifying Official, Date, Telephone Number, and Email Address: The Statement of Compliance must be signed by the contractor or subcontractor, or their agent who paid or supervised the payment of the workers under the contract during the weekly time period covered by the form. Enter the phone number and email address of the individual who is signing the statement and the date signed. Legally valid electronic signatures are acceptable. A legally valid electronic signature includes any electronic process that indicates acceptance of the certified payroll record and includes an electronic method of verifying the signer’s identity. Note: Photocopies or scanned copies of signatures do not satisfy this requirement.

Getting Assistance with the WH-347

Verifying that all boxes are filled correctly to remain in compliance with the Davis-Bacon Act is only part of the compliance process. Having the supplemental documentation to prove that everything reported on the payroll form is the major key to confirming that prevailing wage payments have been met. Verifying proper completion for several weeks of payroll and a wide range of employees may be difficult, and enlisting a team to assist in reviewing documentation would alleviate the stress of reviewing paperwork. We’ll put you in touch with a team of prevailing wage experts who can meet you where you’re at with your current needs – whether it be education with prevailing wage trainings, as-needed support, or full project oversight from start to finish. Get in touch now to secure your projects.