Table of Contents

- Introduction

- What is a Prevailing Wage Determination?

- How Do I Use a Prevailing Wage Determination?

- How Are Prevailing Wage Rates Determined?

- How Do I Find My Prevailing Wage Determination?

- Compliance with Prevailing Wage Determinations

- Conclusion

Introduction

When prevailing wage regulations become applicable on your project at a federal, state, or local level, one crucial aspect that contractors and subcontractors need to understand is the concept of prevailing wage determinations. This guide will walk you through what prevailing wage determinations are, why they are important, and how they impact your projects.

What is a Prevailing Wage Determination?

A prevailing wage determination is a list of wage rates and fringe benefits for each classification of laborers and mechanics. These determinations are issued by the governing body enacting your applicable prevailing wage oversight type. For example, the U.S. Department of Labor (DOL) publishes the determinations under the Davis-Bacon Act. The purpose of prevailing wage determinations is to ensure that workers on federally funded or assisted construction projects are paid wages that are comparable to those paid for similar work in the local area where the project is taking place.

How Do I Use a Prevailing Wage Determination?

Employers and contractors utilize prevailing wage determinations to inform them on how much their workers are owed in accordance with the prevailing wage regulation on their project. Most prevailing wage determination lists include the following:

- Classification/Job Title

- The list of classifications on a prevailing wage determination are what you should be titling your employees on payroll. To know which classification best suits your employees, you must match the scope of work that your employees are performing with the classification that best suits that title. The scope of work consists of the activities being performed, tools being used, and materials being handled. Misclassifying your employees can pose a great risk to your compliance.

- Base Hourly Rate

- This is the base rate expected to be paid to your employees, which can be perceived as a minimum wage specific to this classification.

- Fringe Benefits

- Overtime Owed

- Footnotes

- Footnotes can include crucial information regarding workers’ pay, like potential increases to their wage amounts, differences in how overtime is applicable by the hour, and payments required for travel and subsistence amongst a variety of other potential notes. Reviewing all parts of a prevailing wage determination prevents potentially missing amounts owed to your workers and getting penalized for underpayments.

To see how this is used in a practical sense, check out our video tutorial here.

How Are Prevailing Wage Rates Determined?

Under the Davis-Bacon Act, the Department of Labor conducts surveys to collect wage and fringe benefit data from construction projects in various regions. Based on this data, the DOL establishes prevailing wage rates for different classifications of laborers and mechanics. A similar process can be found across other prevailing wage oversight types, whether that be at the state or local level. These rates are updated periodically to reflect changes in local wage standards.

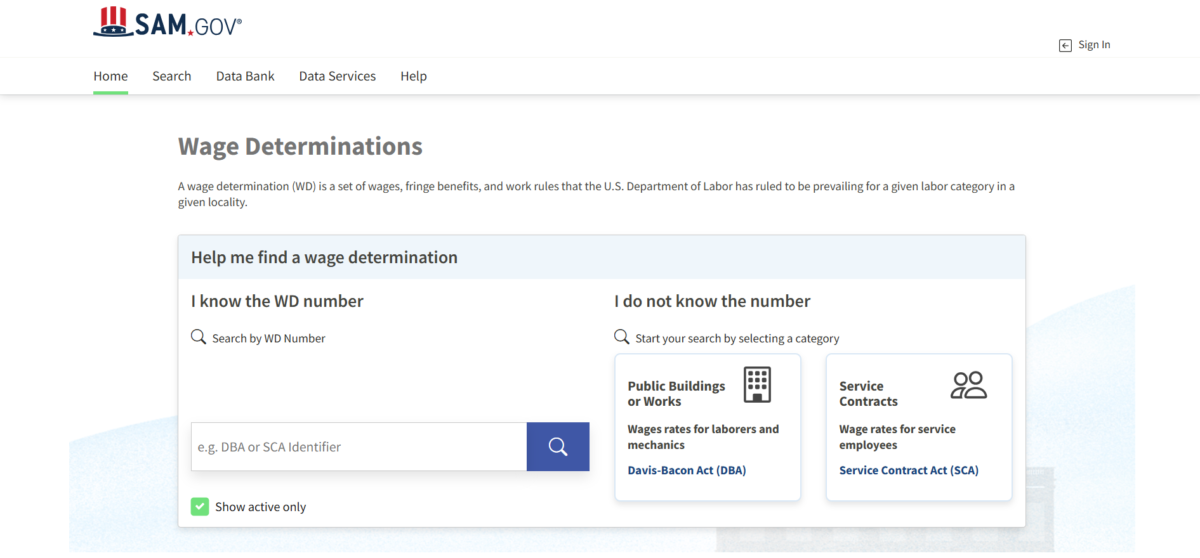

How Do I Find My Prevailing Wage Determination?

To know which determination to use on your project, you must verify how wage determinations are pulled depending on your type. Take a look at the following types as an example:

- FEDERAL EXAMPLE. Davis-Bacon Act – Wage Determinations are dependent on:

- Construction Type (Heavy, Highway, Building, Residential)

- Contract Award Date

- Locality (e.g. the County the project is based in)

- REGULATION EXAMPLE. Inflation Reduction Act – Wage Determinations are dependent on:

- Negotiated Contract Date

- In the absence of a contract or contract execution date, the date used instead is the day construction starts

- Locality (e.g. the County the project is based in)

- Negotiated Contract Date

- STATE EXAMPLE. California – Wage Determinations are dependent on:

- Construction Type (Heavy, Highway, Building, Residential)

- Bid Advertisement Date

- Locality (e.g. the County the project is based in)

If you are unsure of how to locate the prevailing wage determination for your project, or need specific questions answered, we can put you in touch with an expert who can address all your prevailing wage needs. Reach out now to get the clarification you need.

Compliance with Prevailing Wage Determinations

Contractors working on prevailing wage projects must adhere to the wage rates specified in the prevailing wage determinations. This includes paying workers at least the minimum wage rates and providing the required fringe benefits. It’s important that these wages are not only paid to the employees but are demonstrating compliance with the prevailing wage requirements.

Conclusion

Understanding prevailing wage determinations is essential for contractors and subcontractors at all levels on prevailing wage projects. By complying with these determinations, contractors can ensure fair treatment of workers and avoid potential penalties for non-compliance. As a contractor, staying informed about prevailing wage rates and requirements will help you confidently bid on and complete federal projects while upholding high labor standards.